Poland: Weak production as Eurozone sentiment worsens

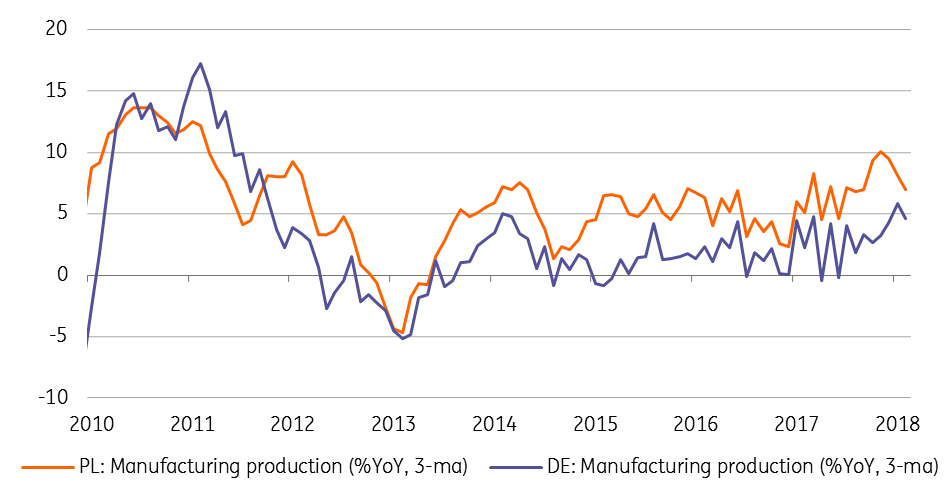

Industrial production surprised negatively due to sluggish export activity. The weakness reflects worsening sentiment in the Eurozone

| 1.8% |

Industrial production growth (YoY) in March |

| Lower than expected | |

Industrial production decelerated in March to 1.8% year-on-year (below the market consensus at 3% YoY) from 7.4%. The rapid slowdown was mainly related to statistical base effects – production growth in the same month a year ago was in the double digits. The negative surprise can be attributed to a moderation from last month’s growth leaders including:

- Export sectors i.e. manufacturing of computers (-7.8% YoY), machinery (-5% YoY). Output in these categories is strongly dependent on Euro-area sentiment, which deteriorated in 1Q18. So far we perceive this slowdown in the developed European economies as a temporary phenomenon and expect a recovery in 2Q18.

- Construction-oriented areas (i.e. production of non-metallic minerals -5.6% YoY). We expect a stabilisation of investment dynamics in the coming quarters after a rapid expansion in 4Q17, which should imply a similar trajectory in those manufacturing sectors.

Manufacturing production Poland vs. Germany (%YoY)

Construction output expanded at 16.2% YoY vs. 31.4% YoY in February (close to the market consensus). Similarly, as in previous months, the key contribution came from civil engineering (nearly 35% YoY) driven by public investment. Construction of buildings accelerated to 17.7%, which underpins strong demand in the real estate sector.

Overall the data provide no reason for the central bank to act on policy. Given the hike-averse MPC stance and risks related to external demand, we see flat rates in Poland at least until 4Q19.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

ProductionDownload

Download snap