Poland: Wage growth solid but still below inflation

In November, employment in the enterprise sector grew by 2.3% year-on-year, in line with consensus and slightly down from the previous month (2.4%). Wage growth was 13.9%, higher than the consensus (12.8%) but still significantly slower than inflation (17.5%). Data shows that wages could be higher than the 12.5% average we have forecast in 2023

The labour market remains sound overall but the situation is deteriorating in some industries after the strong first half of 2022. Above all, manufacturing (especially the furniture industry) is cutting jobs, while the situation in transportation or information and communications remains very good. There is no prospect of a larger increase in unemployment, although a number of industries are clearly slowing down, and construction is likely to face a slump. Demographics and the ongoing ageing of the population play a key role. Companies are hoarding labour fearing problems with re-employment when the slowdown passes. At the same time, some 400,000 refugees have found work in the country since the beginning of the Russian aggression against Ukraine and are most likely not included in CSO enterprise sector employment report.

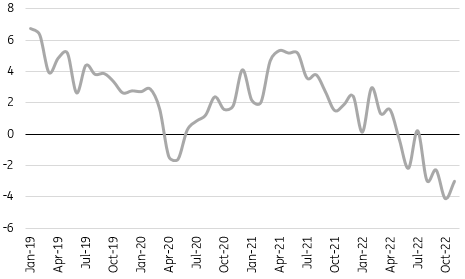

YoY real wage growth in Poland

Below inflation despite overall solid labour demand

Wage growth in the corporate sector was 13.9% YoY, higher than the consensus (12.8%), but still significantly slower than inflation (17.5% YoY). The relatively high wage growth may have been influenced by the earlier payment of bonuses in the mining industry and various inflationary one-off payments. In real terms, however, wages have been declining almost continuously since June, and this is unlikely to change in the first half of next year either. Even a nearly 20% increase in the minimum wage next year will not raise the total wage bill to a level close to the CPI (peaking at around 21% YoY in February). At least for the first two to three quarters of 2023, the wage rate will be below inflation. This is resulting in weaker consumer demand, especially for durable goods, and this effect will only intensify in early 2023. However, November's data shows that wages could surprise to the upside vs. our forecast of 12.5% YoY average growth in 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Poland wagesDownload

Download snap