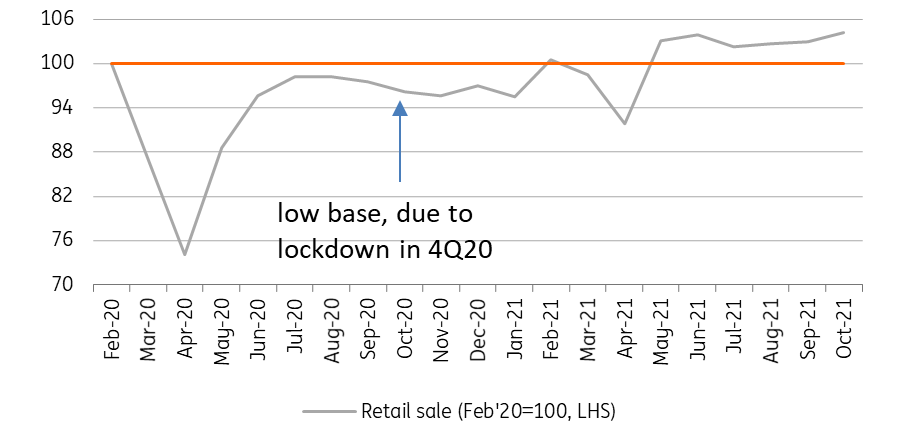

Polish retail sales boosted by low base

Yearly retail sales in Poland have recovered after a soft third quarter. It's no surprise given that this time last year, the country was hit by Covid lockdowns

Polish real retail sales in October increased by 6.9% YoY, marginally above expectations (ING: 6.6%, consensus: 6.3% YoY) and the 3Q21 average (5.8%). Retail trade is supported by low base effects (last year restrictions for restaurants were already in place and people voluntarily reduced visits to shops as they waited for the vaccine rollout). That is why we see improvements across all categories, including those with particularly high rising prices. The retail sales deflator confirms mounting price pressures, rising to 7.5%YoY from 6%.

The low base in 4Q20 should support yearly growth of retail sales now

(Retail sales, the index Feb 20=100)

Most categories show better growth than last month. We saw a broad recovery in fuel sales (6.9% YoY), textiles and footwear (29.3% YoY), and others as restrictions and working from home were introduced in 2020. On the other hand sales of household appliances slowed to near zero, as last year people were preparing to work and learn at home. The data confirms that new car availability remains poor; sales declined by 5.2% YoY.

In the coming months, the negative impact of CPI on retail sales should be overshadowed by low base effects from 4Q20, as you can see in the chart above. As of October 2020, health restrictions were introduced in restaurants, and in shops in November. Unlike those months, this year we're seeing neither official restrictions nor a meaningful decline in mobility. So, the average retail sales growth in the fourth quarter of this year should stand close to 6.5-7.0%YoY vs 4.8%YoY in 3Q21.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

PolandDownload

Download snap