Poland: GDP slowed in 4Q18, but fiscal impulse imminent

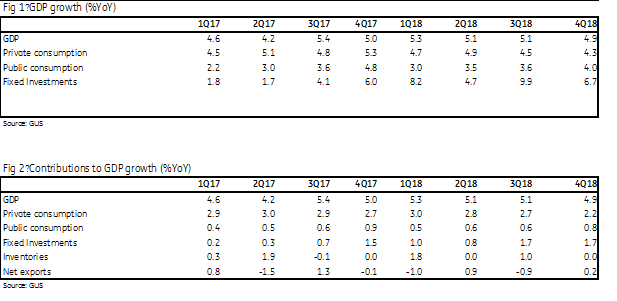

4Q GDP growth decelerated to 4.9% YoY, with quarterly dynamics at their lowest since 3Q16. Domestic demand temporarily decelerated, with the impact of Eurozone slowdown barely apparent. We remain confident on activity in coming quarters, but have concerns about its structure.

The second estimate of 4Q GDP growth confirmed a limited slowdown, from 5.1% to 4.9% YoY. Quarterly growth was at only 0.5% – its lowest since 3Q16.The slowdown in 4Q18 was caused by temporarily slower growth in domestic demand and by a deceleration in the Eurozone. Private consumption growth moderated from 4.5% to 4.3% YoY and investment growth dynamics decelerated from 9.9% to 6.7% YoY.

Net exports surprisingly recorded a positive contribution (0.2ppt), much stronger than in 3Q (-0.9ppt). The strong volatility of this component looks to be related to accounting techniques. Simultaneously, the contribution from inventories collapsed from +1ppt in 3Q18 to zero in 4Q18. In the final data we might see lower net exports but higher inventories.

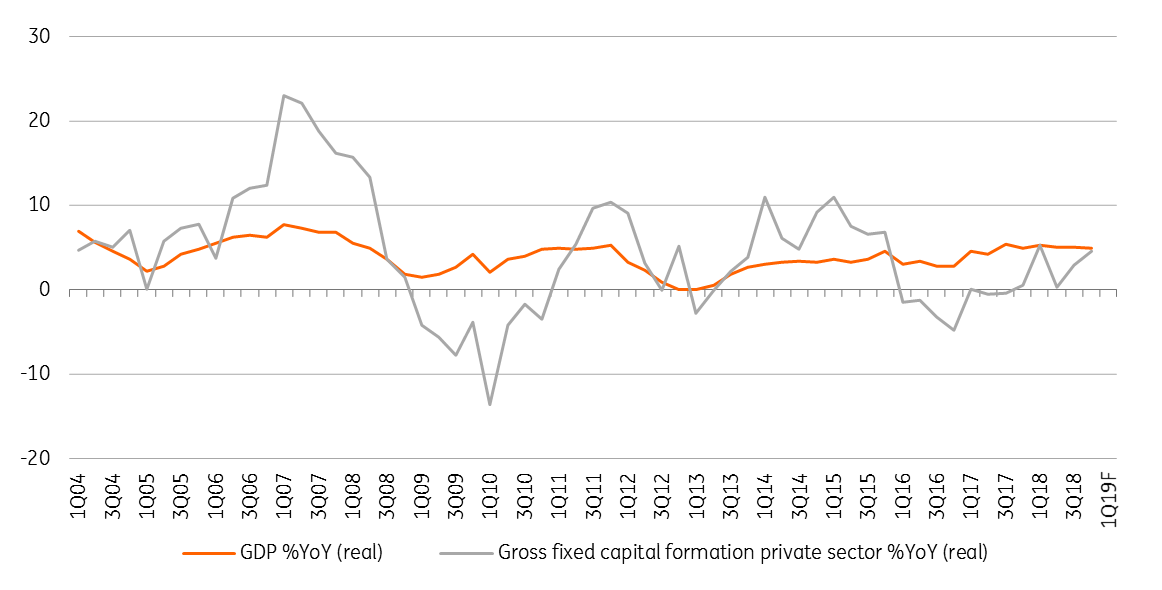

We note the unfavourable structure of GDP. While the consumption boom slowed only gradually in 4Q, this component should reaccelerate on fiscal impulse. On the other hand investment has slowed substantially, something unusual at this stage of business cycle. The structure of investment provides an answer. We estimate that public expenditures accelerated strongly in 2018, by approximately 24% YoY, while growth in private outlays was muted – we estimate at 3.5% YoY only. This weakness inprivate investment reflects both the rigorous tax policy and the worsening of sentiment in the Eurozone.

Looking ahead we remain confident that GDP can sustain 4% YoY growth in 2019 and fall only slightly in 2020. Recently, the ruling PiS announced a fiscal expansion plan (to 1.7% of GDP), which in our opinion should add up to 0.6ppt to GDP in 2019 and 0.8ppt in 2020. Unfortunately, the new social programmes are likely to stimulate private consumption expenditure and so sustain its growth dynamics even at 4.5-5% YoY over the next two years.

Private investments (%YoY): for the first time ever growth was slower than GDP. We expect this to persist on the Eurozone slowdown and rigorous tax policy

We see downside risk for investments as tax policy should remain tight (to fund generous election pledges). Additionally, the prolonged slowdown in the Eurozone may result in cuts in exporters' investment plans . We expect that GDP growth will rely solely on consumption and so from 2021 onwards besubstantially lower than in previous years.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap