Polish inflation temporarily eases in February

Inflation in Poland underperformed expectations in February. We still view the decline in core inflation as transitory and expect average CPI to reach 3.2-3.4% YoY in 2021

| 2.4% YoY |

CPI in FebruaryConsensus at 2.5% YoY |

| Lower than expected | |

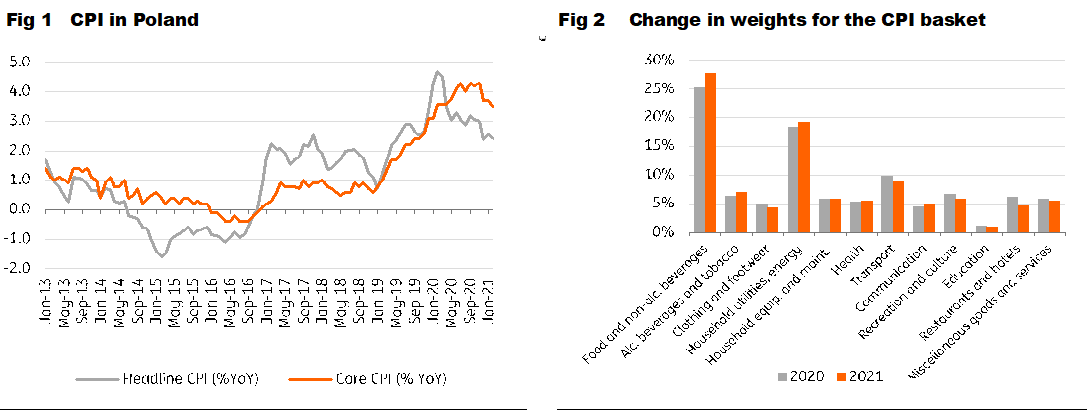

In February, inflation in Poland fell to 2.4% YoY compared to 2.6% in January, which was revised down from 2.7%. Market expectations were 2.5%.

Slowing inflation was largely due to lower energy prices (4.1% YoY vs 6.1% in January) and the decline in core components. We estimate that core inflation in February fell to 3.5% YoY from 3.7% in January and December. Given the scale of the slowdown in 2020, we think the deceleration in core CPI in February is modest and related more to a high base from February 2020.

The statistical office has published data for February adjusted the weights for the CPI basket to the structure of consumption in 2020. As we expected, the share of food increased at the expense of services, which primarily helped bring down the inflation reading.

Food prices growth (0.8% YoY in January and 0.6% YoY in February) is clearly lower than in service prices (7.4% YoY in January and 7.0% YoY in February). Moreover, the pace of service prices at the beginning of the year is approximately a percentage point higher than in December.

This is partly the effect of rising communications prices, probably related to higher RTV subscriptions.

Lower price growth at the beginning of the year is transitory

Core inflation is expected to decelerate further, but only to a moderate extent. On the one hand, the lagged effects of the recession will work, but on the other hand, we see price pressures in global supply chains.

China's PPI this year could jump to around 8% YoY and thus reach the peak last seen in 2017 and 2011. We also see risks from higher commodity prices, i.e. fuels and metals. The low base for food and fuel prices will also stop working in the coming months.

We estimate that, on average, CPI inflation in Poland 2021 should reach 3.2-3.4% YoY. A higher forecast does not change our approach indicating that the central bank should keep rates unchanged until the end of its term (mid-2022).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap