Surprising surpluses in Poland’s current account and trade balance

Positive surprises in the January current account and merchandise trade balances are supportive of the zloty. Low imports growth indicates weak consumer demand and downward adjustment in inventories

The current account balance surplus in January and the first surplus in the goods balance in one-and-a-half years are positive surprises. The positive current account balance of €1.4bn in January was above consensus, which assumed a deficit of €0.7bn and our forecast (a deficit of €0.5bn) and a deficit of €2.5bn in December. The positive merchandise trade balance in January was €1.2m compared with a deficit of €2.7m in December.

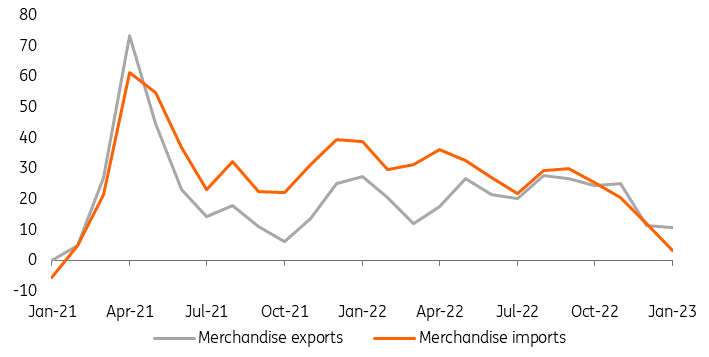

We estimate the 12-month current account deficit-to-GDP ratio narrowed to about 2.7% in January from 3.1% of GDP in December, but was one percentage point higher than in January 2022 (1.7% of GDP). In addition to the trade surplus, the current account recorded a surplus in services (€3.4bn), a deficit in primary income (€2.6bn) and a deficit in secondary income (€0.6bn). January brought a further decline in the trade growth year-on-year, which was associated, among other things, with slower, although still likely double-digit, growth in transaction prices. Declines in commodity prices, particularly natural gas, had an impact in the direction of lower price dynamics. The value of exports expressed in euro increased by 10.8% YoY, and imports by 3.1% YoY. The deep decline in the value of imports indicates a strong adjustment in foreign trade with weak consumer demand and a downward adjustment in inventories.

The demand barrier is beginning to weigh heavily on foreign trade performance, with a smaller role played by improvements in the functioning of global supply chains, including the auto industry, among others. Fed data indicate that the index of pressure in global supply chains returned to normal levels in early 2023, similar to the situation in the summer of 2019, i.e. before the Covid-19 pandemic. According to the National Bank of Poland release, on the export side, sales in the automotive industry (cars, vans, buses and automotive parts) grew strongly. Exports of food and fuel expanded significantly as well. On the import side, fuel purchases continued to grow, albeit more slowly than in 2022. Low import dynamics were affected by supply goods (iron and steel and plastic intermediates) and consumer goods.

The strengthening of the current account balance in relation to GDP observed in recent months is a positive factor for the zloty. We expect that in the coming months the relatively solid performance of exports will be accompanied by lower dynamics of imports, which in Poland are characterised by greater sensitivity to economic performance. With less unfavourable terms of trade, this should translate into a further reduction of the current account deficit to around 2% of GDP by the end of 2023. The main risks towards a larger external gap are forthcoming spending on arms purchases and possible renewed increases in commodity prices, e.g. due to higher demand from China.

Growth of exports and imports, YoY, in %

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap