Poland: Superb production performance calls for near 5% GDP growth in 4Q17

The overall performance of the Polish economy (with strong wages and activity) is outpacing NBP projections. But we see only 4 MPC members ready to support a hike sometime in 2018, and finding further support is difficult.

Industrial production accelerated from 4.3% YoY to 12.3% YoY (strongly above market consensus – 9.9% YoY). The double digit figures were supported by both statistical base effect (Oct-16 production fell into negative territory at -1.3% YoY) and positive working day difference (+1 vs. one month ago). Still the changes indynamics in seasonally adjusted terms were impressive, with acceleration from 6.9% YoY to 9.7% YoY. GUS comment indicates rather broad-based acceleration with leading role of manufacturing (14.0% YoY) especially in case of intermediate & capital goods, but also with sectors related to construction (production of metal and related products). Still double digit growth seems unlikely in forthcoming months - we expect rather moderation of industrial production to about 8% YoY in Nov-17 and 4% YoY in Dec-17.

| 12.3 |

Industrial production (%YoY) |

| Better than expected | |

The construction output accelerated modestly from 15.5% YoY to 20.3% YoY (below expectations (24% YoY). We still see relatively low expansion of EU funds – in 3Q17 BGK paid PLN6.75bn, which is still below average payments for the third quarter from previous perspectives (PLN10.3bn). But in YoY terms this is nearly double what was paid last year (PLN3.5bn), so the low base effects helps.

Retail sales came close to market expectations at 7.1% YoY (vs. 7.5% YoY in September). Car sales volume continued positive acceleration (from 7.1% YoY to 11.8% YoY), as did durable goods purchases (RTV & household appliances) and semi-durables (miscellaneous products), maintaining their solid pace (respectively 12.0% YoY and 9.8% YoY). Supportive effects of child benefit and wage acceleration seem still to be bolstering consumption.

All in all, todays data remains consistent with another very strong GDP reading. We don’t have details about recent GDP structure, but based on our estimates we see next quarter reading even slightly stronger than observed already in 3Q17. We estimate 4Q17 GDP dynamics close to 4.7-5% YoY vs 4.7% YoY seen in 3Q17.

The recent activity outpace trajectories presented by the recent NBP inflation projections, yet both strong wages and superb activity levels are unlikely to change MPC members' approach.

After the last NBP projection, in a long series of comment we see only 4 MPC members ready to support hike sometime in 2018, ie earlier than governor Glapinski is calling for (after 2018). We see Gatnar, Hardt, Zubelewicz and Osiatynski in the hawks camp. Swing voters whose vote are crucial are Kropiwnicki, Ancyparowicz and Sura – still rather following the governor. The NBP CPI projections should be undermined strongly before they change their mind. We assume the rate hike is most probable at 4Q18 with 30-40% of the earlier move.

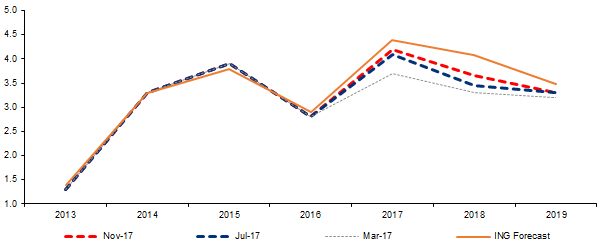

NBP - GDP projections (%YoY) vs. ING forecasts

Recent activity strongly outpace NBP projection. We see 2018 forecast as too conservative.