Poland: Strong job market despite eurozone slowdown

Labour market data from the enterprise sector surprised positively, both in the case of age and employment. So far, the eurozone slowdown has had a benign impact on the domestic job market

Wages

In January, wages in the enterprise sector grew by 7.5% year-on-year vs 6.1% a month ago, above the market consensus (6.7%) and close to our forecast (7.3%). The December reading was subdued due to the statistical effects in retail trade and a lower contribution from bonus payments in the mining sector compared to 2017 – both of these effects dissipated in January. Secondly, the overall aggregate was increased by 0.4 percentage points due to a stronger increase of the minimum wage than in 2018.

Looking ahead, we expect wages to stabilise in the 7.0-7.5% YoY range. According to the National Bank of Poland Survey, the number of enterprises considering wage hikes is higher compared to last year (48.6% in 1Q19 vs. 39.4% year ago). This should offset, for example, the lower contribution from construction.

Employment:

Enterprise employment increased slightly from 2.8% to 2.9% YoY, also above the market consensus (1.8%). Changes in January are related to annual shifts in the panel of enterprises. Therefore the data doesn't correctly reflect the employment trend.

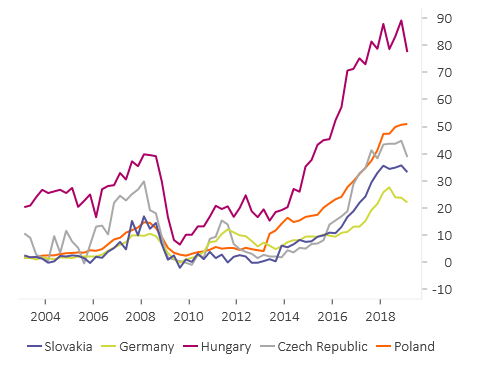

So far we see a benign impact of the slowdown in the eurozone on the domestic labour market. The European Commission's survey among manufacturing sector companies showed Poland was the only economy where the share of firms reporting labour shortages did not fall in 4Q18 compared to the previous quarter. Therefore looking ahead, we see a moderation in employment growth, driven by a labour shortage, rather than demand shocks.

Labour shortage (%)

% of manufacturing companies reporting labor shortage as a growth barrier

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap