Poland: Stable rates for the long-term (at least till 2020)

The MPC left rates unchanged. We expect dovish remarks as inflation is likely to undershoot the central bank's projection

The MPC has left interest rate unchanged, in line with market expectations. We expect more dovish rhetoric during the press conference (4.00 CET). National Bank of Poland Governor Adam Glapinski is likely to reiterate that interest rates will not rise in either 2018 and 2019. He should also add that the probability of a rate increase beyond that period (in 2020) has diminished compared to last month.

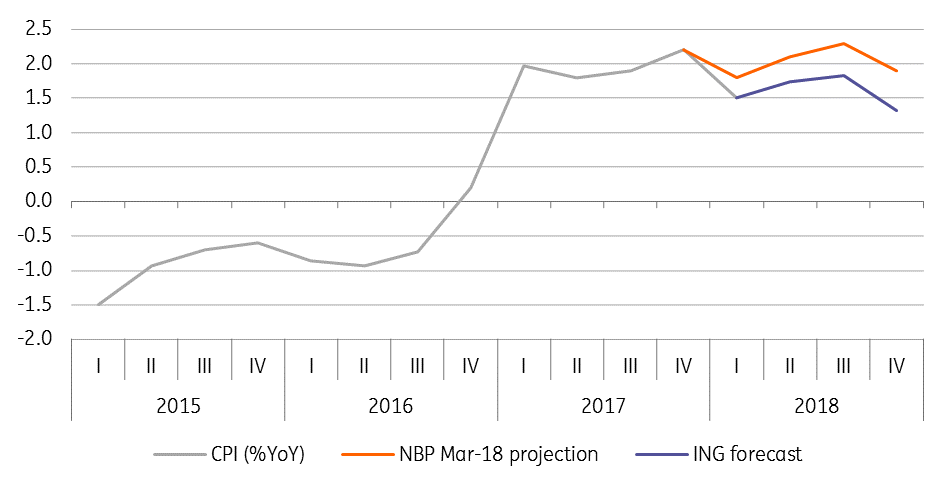

The major argument for a dovish stance is persistently weak core inflation. April's CPI, excluding food and energy prices, likely decelerated to 0.6% year on year and we see a limited space for improvement in the coming months (inflation expectations deteriorated amongst business sectors). As a result, CPI should strongly undershoot the NBP projections in March.

CPI (%YoY) - the NBP projection vs. ING forecasts

The MPC should also note that despite robust GDP growth in 1Q18 (5.1%YoY), the outlook for the second quarter is increasingly uncertain, with negative risks for external demand stemming from weaker sentiment in the Eurozone.

Finally, the dovish and centrist members may be more cautious about investment prospects after a negative surprise from a 4Q17 revision (dynamics were lowered from 11.2%YoY to 5.4%YoY). We expect committee members to await a stabilisation of these dynamics at stronger levels for a few consecutive quarters before altering their stance.

All in all, we expect the MPC to forecast that it will not raise rates in 2018 and 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap