Poland: Spillovers from wage growth not visible in CPI

A final reading on Poland's CPI confirms limited pressure in categories related to services. This supports a dovish central bank stance – we think recent guidance (flat rates till 2020) still holds

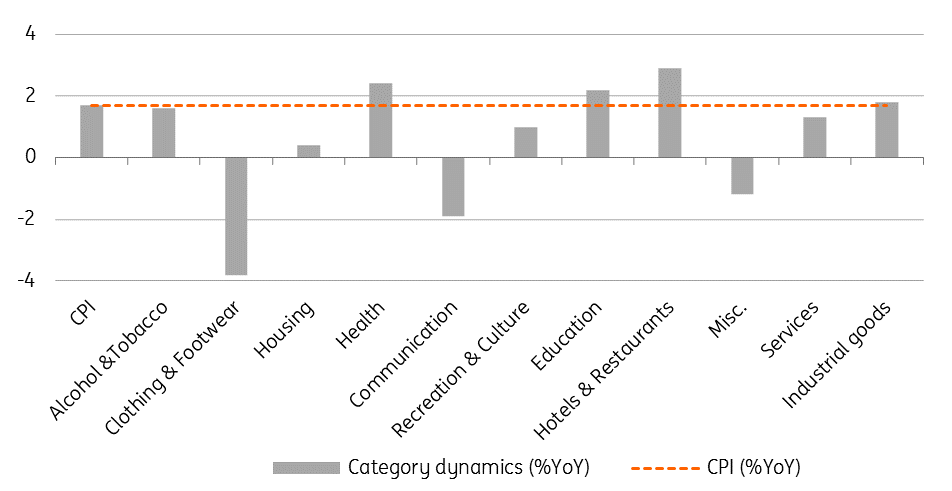

The final reading on CPI has confirmed growth of 1.7% YoY in May. Based on data provided by the official statistics office GUS, we estimate core inflation was flat at 0.6% YoY, which underlines a virtually non-existent transmission of wages into prices.

The major factor behind the weakness in core inflation, similarly to previous months, was the negative drag from insurance and banking services (categorised as miscellaneous goods). This category showed another 0.5% month on month drop in May. Secondly, growth in the recreation and culture category was only moderate, and another drop in package holidays lowered CPI by 0.06pp (core by 0.1pp). Still, there seems to be limited increase in other categories - overall services fell from 1.7% YoY to 1.3% YoY.

CPI - dynamics in selected categories

Looking ahead, we expect June's headline CPI reading to exceed 2% YoY, again on fuel prices. Still from July onwards, CPI is likely to decelerate as base effects weigh on the headline figure. Overall, the lack of inflationary pressures support a dovish MPC stance – we see recent guidance (flat rates till 2020) as safe.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap