Poland: Soft retail activity in April. GDP to moderate in 2Q

Retail sales surprised negatively in April and 1Q18 investments of big companies failed to impress. The overall picture remains consistent with a moderation of GDP in 2Q18

Retail sales decelerated from 9.2% year-on-year to 4.6%, strongly below the market consensus (7.9% YoY). Surprisingly, a sharp deceleration occurred in food and megastores sales (respectively -10.4% YoY and -1.4% YoY), likely reflecting a negative base effect after an earlier Easter (which was stronger than the historical trend). The Sunday retail trade ban, which took effect 11 March, probably had a minor effect.

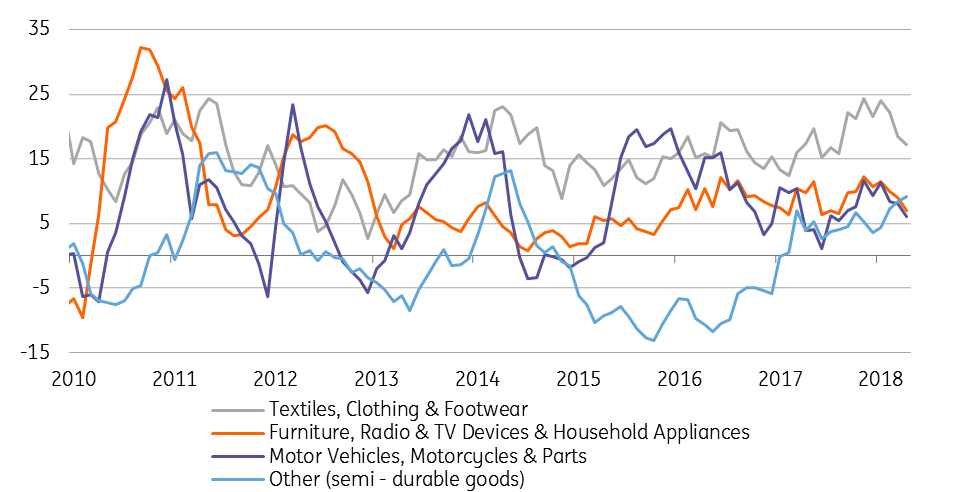

Categories related to durable goods i.e. sales of motor vehicles and household appliances, continued to decelerate, suppressed by base effects (see the chart below), while sales of semi-durable goods increased.

Retail sales volume in selected categories (%YoY, 3-ma)

Poland's official statistics office GUS has also published data on the investment of enterprises employing more than 50 workers in 1Q18. Growth in this category was 6.6% YoY and likely underperformed overall investments (we expect 12% YoY – 1Q18 GDP structure will be published next week). GUS highlighted a major contribution from the transportation sector (86.8% YoY), which could be related to national railways (also supported by EU funds). Retail trade also posted a strong 31.9% YoY increase (possibly due to automation amid a labour shortage). A strong negative drag came from the energy sector (-28.3%YoY).

| 4.6 |

GDP (%YoY)ING forecast for 2Q18 |

The overall picture remains consistent with GDP deceleration in 2Q18 (we expect a slide from 5.1% YoY to 4.6% YoY). Private consumption should reflect the downward trend visible in retail sales and slow from an estimated 5.1% YoY in 1Q18 to 4.3% YoY. Double-digit investment growth is also unlikely in 2Q18.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap