Poland: Robust third-quarter GDP but with a poor structure

Covid-19 aggravated the unfavourable GDP structure of strong consumption and weak investments. The government plans to stimulate public investment in 2021, hoping for private ones to join in later

| -1.5% |

GDP growth in 3Q20 (YoY)second reading, better than flash estimate |

| Better than expected | |

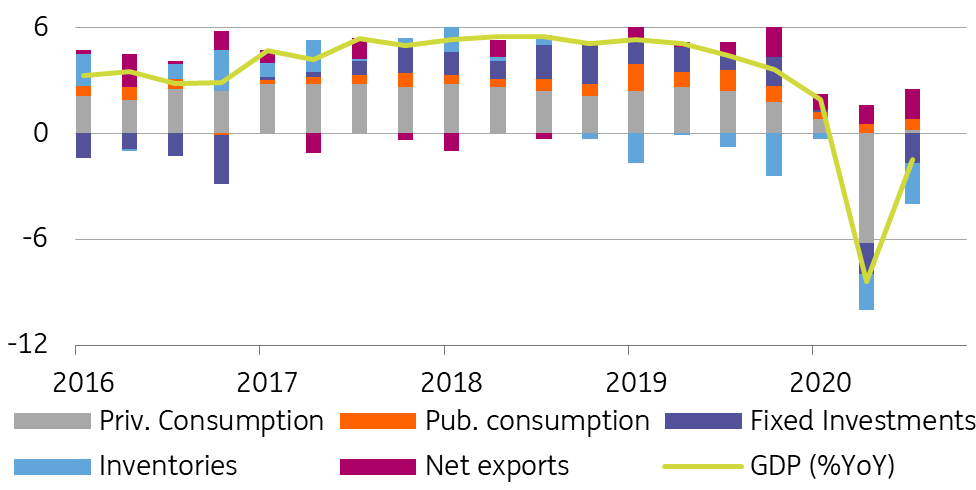

According to the second estimate GDP increased by 7.9% quarter-on-quarter in 3Q20, after a record drop of 9% QoQ in 2Q20. In year-on-year terms, the GDP growth was -1.5% vs. -8.4% in 2Q20.

The acceleration was mainly due to a rebound in household consumption (+0.4% YoY vs. -10.8% YoY 2Q20). A typical post-crisis recovery and differed demand were reinforced by a record-high fiscal stimulus, which prevented an unemployment jump and strengthened the propensity to consume.

Investments declined by 9% YoY, almost as weak as in 2Q20 (-10.7% YoY). We estimate that the public outlays continued to grow (over 10% YoY), as indicated by the rate of EU funds paid (+35% YoY in 3Q20 vs. 14.3% YoY in 2Q20). The private investments decline was probably shallower than the 14% YoY in 2Q20, but likely nearly double-digits. Net exports added 1.7 percentage points to GDP in 3Q20, compared to 0.9-1.1ppt in 1-2Q20.

GDP: composition of growth (YoY)

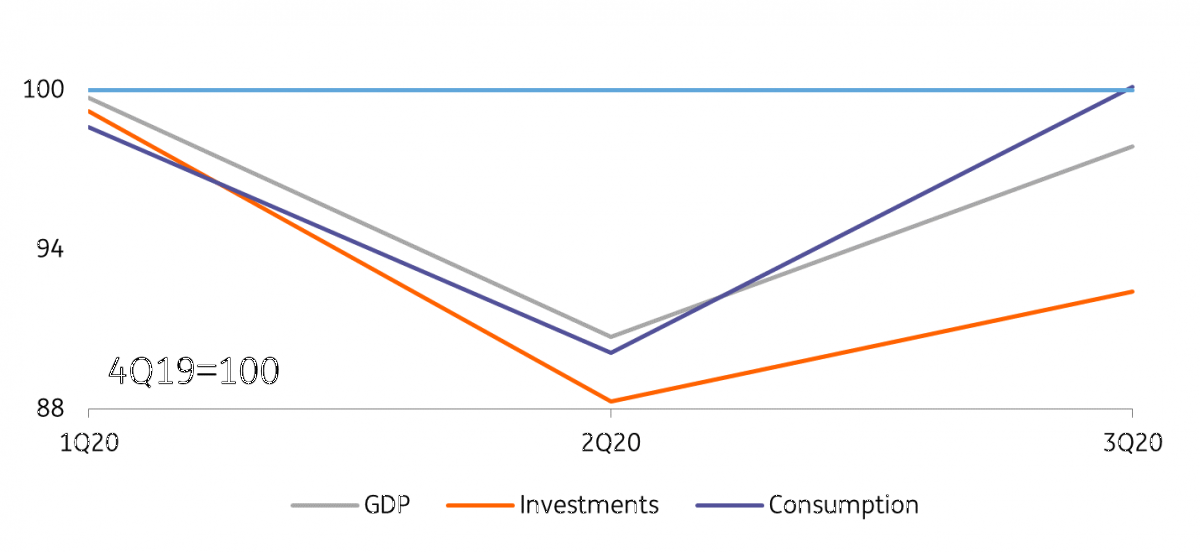

After seasonal adjustment, real consumption is already above the pre-pandemic 4Q19 level. Investments are still about 7.5% lower. Such a structure doesn’t support a recovery in potential growth. If persistent, it may affect competitiveness and generate inflationary pressure. This shows that there is scope for programmes supporting corporate confidence and investments.

Growth structure as compared to 4Q19

The new pandemic wave, a deterioration in hard data in October and a collapse in soft figures in November indicate a renewed GDP drop in 4Q20. Our index gauging the "economy freeze" (aggregating mobility data and official restrictions) shows that in mid-November the degree of the effective lockdown was comparable to the 2Q20 average. This reflects new restrictions and a decrease in mobility (in retail trade the mobility has already dropped two-thirds of that from 2Q20). Data on payments show a strong collapse in activity in services, especially those heavily affected by the lockdown, similar to 2Q20.

Some optimism is shown by our transactional data, which indicate a jump in sales of goods at the end of October / beginning of November – probably on the eve of the announced national lockdown. Foreign demand is also stronger than in 2Q20, given stronger industrial activity abroad, especially in Germany.

We estimate that the GDP decline should deepen to about -4.5% YoY in 4Q20, yielding -3.3% YoY in 2020 on average. 1Q21 activity is at risk as well – most likely only a fraction of the population will be vaccinated by then. In addition, historical data shows that the turn of February and March is a traditional flu peak in Poland. We estimate a quicker economic recovery starting from 2Q21.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap