Polish central bank remains vigilant

As Poland's central bank kept rates on hold today, their projections for 2020 GDP are considerably below consensus. We think the Bank is keen to enhance easing if the economy suffers again in 2H20 due to a second Covid-19 wave

Poland's central bank decided to leave rates on hold today, in line with our and market expectations.

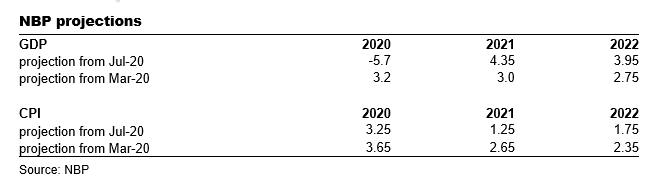

The press release stated that the economic recovery taking place abroad raises the odds growth picking up pace in Poland, but uncertainty remains high. This opinion is underlined by the central bank's new economic projections i.e, GDP for 2020 at -5.7% year on year on average. This is much below consensus (-3.5%YoY to -3.8%yoy) and our expectations of about -4% YoY.

In our view, the central bank remains vigilant. If the economy suffers in 2H20 due to the second wave of Covid-19, a new fiscal program and more QE is likely to be on the agenda reaching at least 7-8% of GDP vs about 4.5% of GDP now. We estimate next year's government deficit to be around 5% of GDP. The government may face obstacles to finance it without central bank support.

So far, the Bank's actions support the funding of large fiscal programs launched by the government (which we estimate at about 11% of GDP). However, NBP actions had any impact of credit creation. The LTRO-like program started in March doesn’t work and private credit is painfully slow, which is probably why MPC is presumably discussing new measures supporting credit creation.

But the proposal of Professor Łukasz Hardt – hawkish MPC member (a hike of the main rate and launching growth funding scheme) seems to be outside the MPC consensus. Especially the hike of the main rate, which would raise the costs of servicing government debt. The introduction of the second part of his proposal is more likely.

To recap, this year the central bank has launched conventional easing measures (140bp cut of base rate, cut of mandatory reserve which released PLN40bn of liquidity) and unconventional measures (QE which has reached 4.5% of GDP so far).

We expect the main rate to stay at 0.1% for a while, at least until the end of the MPC term at the beginning of 2022.

The MPC maintains the opinion that the strong PLN is slowing GDP recovery. We perceive it as a verbal intervention only, however, if the currency strengthens further (which isn't the case now), the central bank may try to act. But the central bank is unlikely to defend any particular level, they are likely to just slow PLN appreciation.

But, for now, that remains a distant story.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap