Poland: Rates to stay low as core inflation decelerates

The Monetary Policy Council left rates unchanged. We expect stable rates in 2018 and 2019 and think the MPC will extend its guidance into 2020 in the second half of this year

Poland's MPC left interest rates unchanged, in line with expectations. At a press conference later (4:00 CET) central bank governor Adam Glapiński will probably reiterate that there is no need to increase rates in 2018 and 2019. We don't expect further comments regarding the outlook for 2020. Instead, MPC members are likely to point out that they are paying strong attention to July inflation projections.

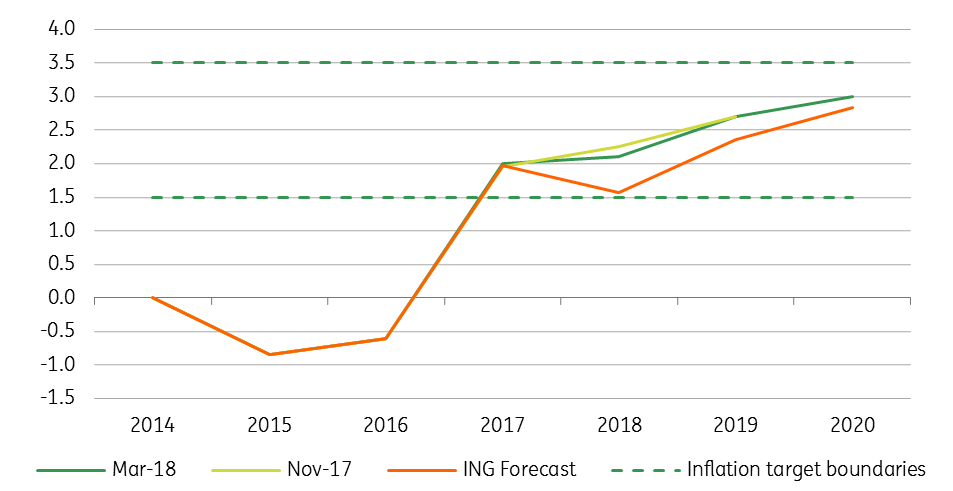

We expect new National Bank of Poland forecasts (published at the next meeting in July) to show a lower core inflation trajectory and therefore lower CPI. The March projections assumed that core prices would stand at 1.5% year on year by the end of the second quarter. The May release suggests instead that the pace is almost a full percentage point lower. As a consequence, the overall CPI trajectory should be also revised downwards, despite the recent surge of oil prices. We forecast average CPI at 1.6% YoY in 2018, well below the March projection (2.1% YoY).

Secondly, the forecast for GDP is likely to be softer over the long-term. We expect that it will be revised down in 2019 and 2020, due to weakening economic sentiment in the Eurozone and disappointing investment growth in Poland.

NBP CPI inflation projection vs. ING forecasts

We expect the MPC to maintain stable rates both in 2018 and 2019. Given supportive economic conditions and the still-distant prospect of an ECB interest rate hike, committee members are likely to extend the guidance into 2020 in the second half of 2018 (likely in July or November with the release of new economic projections).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap