Poland: PMI survey highlights inflation risk

Despite a drop in the headline PMI figure, new orders and employment remain sound. The survey also points to a rise in business inflation expectations

Poland's PMI manufacturing index decelerated from 55pt to 54.6pt, below market expectations. IHS Markit points to lower current production, delivery time and quantity of purchases. However, new orders accelerated at the fastest pace since January 2015, suggesting a stronger outlook over the medium term.

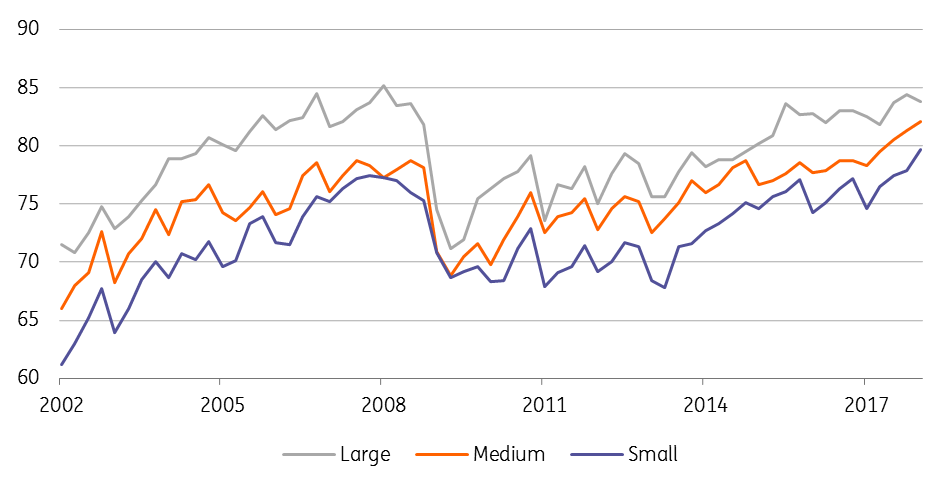

The survey points to a continuing problem with insufficient productive capacity (for four straight months). This was also confirmed by a report from the statistical office, which showed small and medium enterprises working at the highest rates on record. Given strong demand (both domestic and external), an acceleration of private investment to boost capacity seems likely.

Capacity utilization by enterprise size (%)

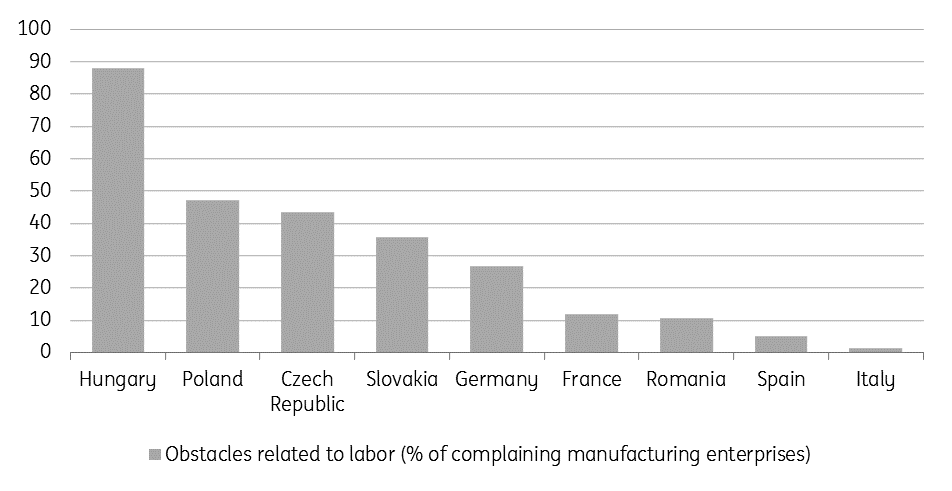

The labour market remains positive – with the PMI component increasing at the fastest pace in nine months. IHS Markit did not suggest there was a problem with labour shortages although Poland's statistical office does highlight this as an issue. Moreover, the European Commission has indicated that a shortage of labour is more common in CE4 compared to western Europe. In Hungary, these problems are reported by 87.9% of manufacturing entities, in Poland 47.3%, Czechia 43.4% and Slovakia 35.7% (for comparison, in Germany this number is 26.7%).

Obstacles related to labor in manufacturing (% of reporting companies)

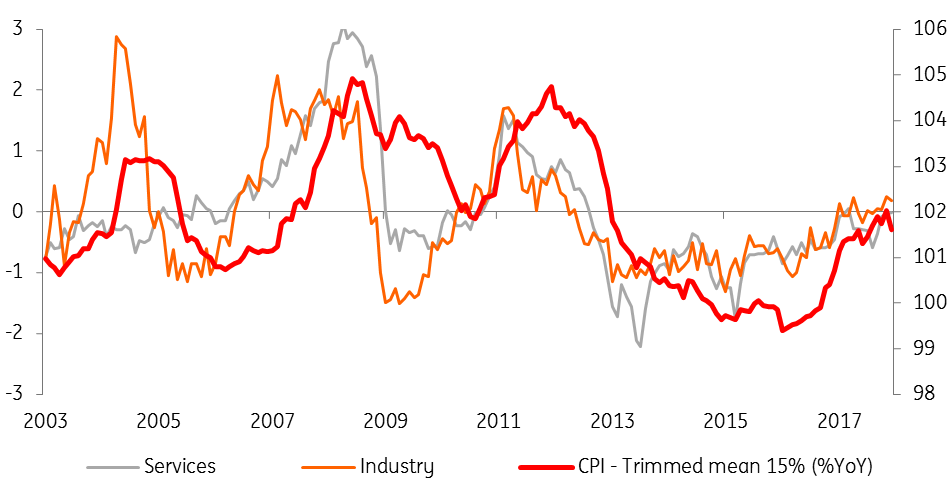

In terms of inflation, the survey shows the fastest acceleration of output prices since April 2011. Business inflation expectations measured by the statistics office (GUS) rose in every sector of economy. We perceive this as a sign that core inflation will pick up, especially in 2H18.

Normalized inflation expectations and CPI trimmed mean (%YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap