Poland: Negative surprises in the labour market

Both corporate wages and employment came in below market expectations in August and we think this emphasises labour shortages. Expect the increase in wages in 4Q18 to be relatively small

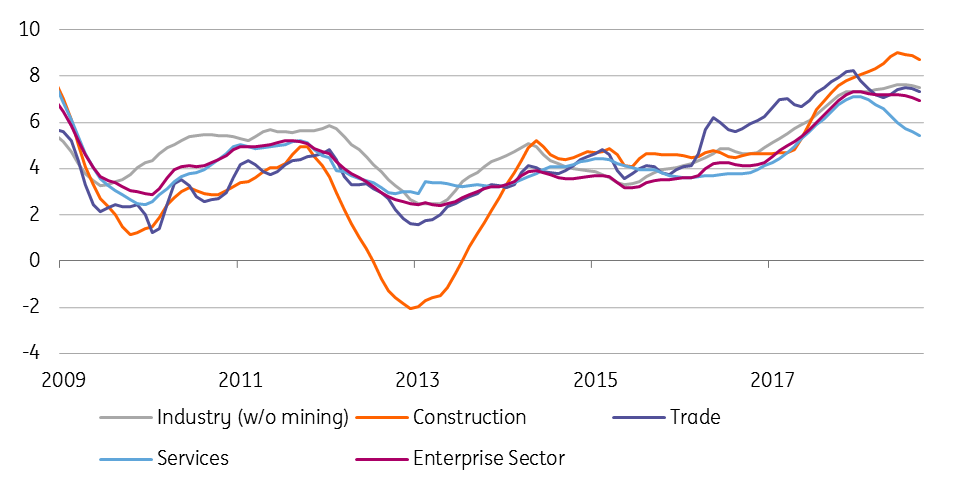

Corporate wages slowed down from 7.2% to 6.8% year on year and came in below the market consensus of 7.0%YoY. The detailed structure should be available in two weeks, and we expect to see a cross-sectoral divergence.

The solid dynamics have been increasingly reliant on the construction sector (benefiting from EU projects), while branches where labour shortage problem induced above-average growth in 2H17 and 1H18 (i.e. retail trade, transportation and administration services), are now in moderation.

Secondly, the central bank survey suggests a cyclical slowdown of wage pressures – share of companies willing to hike wages was stable both in 2Q and 3Q after the rapid expansion in 2017.

Therefore, we see limited room for further increase in wages. We forecast the peak of dynamics in 4Q18 – corporate wages should hover around 8-8.5%YoY. The rise in the minimum wage to 7.1% in 2019 should maintain such dynamics in 1Q19, but after that, we expect moderation afterwards and a return towards 7%YoY in 2H19.

Enterprise employment also came in slightly below expectations – the headline dynamics decreased by 0.1pp to 3.4%YoY, as data for August came below the seasonal trend.

Divergent structure of wage growth (%YoY)

Underlying trends were derived with TRAMO/SEATS algorithm.

In our opinion, this phenomenon emphasises labour shortage and the slowdown should continue in the next few months ahead.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap