Poland: Inflation wave spreads

The final CPI in October, at 6.8%, confirms another wave of commodity price rises. However, inflation continues to spread, particularly to goods, where prices rose from 1.1% in January to 6.8% year-on-year currently

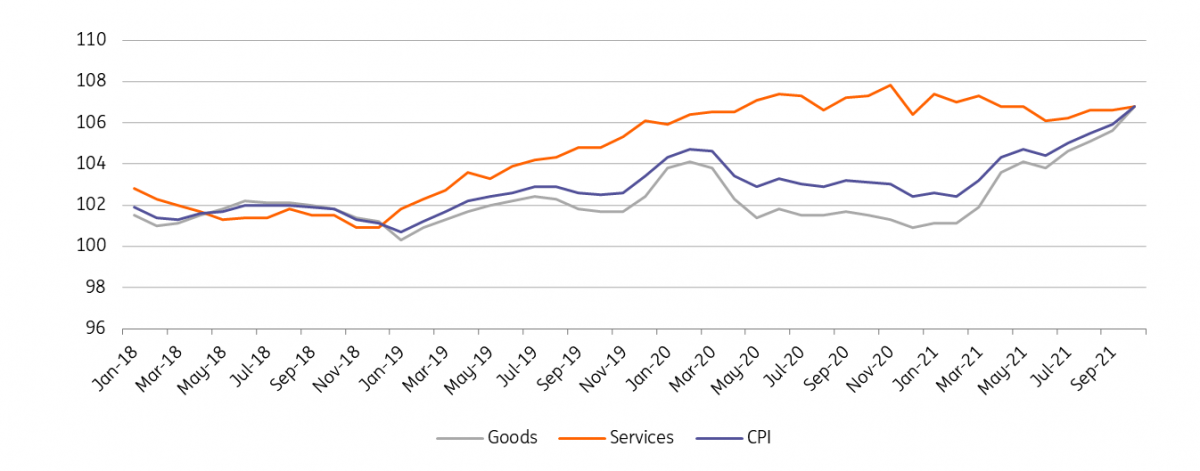

CPI components shows goods inflation strongly accelerated (Index: previous year = 100)

October CPI was confirmed at 6.8% YoY. This month, the contribution to CPI from external factors was very highy, i.e. fuel prices and energy (due to natural gas) added 0.3ppt each to the 0.9ppt rise in headline CPI (from 5.9% YoY in September to 6.8% YoY in October). But the inflationary pressure is also spreading widely across the CPI basket, most evidently across goods – prices of this component increased from 1.1% in January to 6.8% YoY in October. Inflation of goods’ prices matched that of services (also 6.8% YoY in October). We estimate net core inflation at 4.5% YoY, up from 4.2% YoY a month prior. We forecast headline CPI at 7.8-8.0% YoY in December.

Next year's headline CPI will decelerate, but the core will remain elevated

Supply-side factors have been a primary driver of accelerating inflation since the spring. In 2022, the contribution from demand-side pressures and wages should take the lead in holding core inflation at elevated levels. This reflects a very strong labor market and overall internal demand as well as the inflationary policy mix. That's why these countries are at risk of persistent inflation, even if external factors fade. Across central and eastern European countries, we see strong rises in the minimal wage (Hungary & Romania), or further fiscal expansion (Poland, expected to widen the structural imbalance from 4% to 5% of GDP next year).

We see the terminal rate across the CEE region, including Poland, to be around 3%, which should be reached in late 2022 or early 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap