Polish inflation inches down in October

The flash CPI came in line with expectations but we expect November inflation projections to shed light on the future trends

| 2.1 |

Headline Inflation%YoY dynamics |

| As expected | |

In October the yearly CPI inflation slowed down by 0.1pp to 2.1% year-on-year, in line with expectations. Although the detailed structure is unavailable – we assume major upward pressure still comes from food prices which is growing much faster compared to the headline CPI.

We estimate food prices dynamics at 4.9%YoY driven mainly by problems with the supply of domestic fruits, i.e. apples and dairy products. Secondly, energy prices accelerated moderately with increased heating cost, which is another supply shock, caused by the deficiency of heating coal.

We estimate core inflation stabilised at 1%YoY. Last month 's increase of 0.3pp was mainly caused by regulatory issues including changes in education and new textbooks alongside higher clothing prices due to weather-driven effects. Detailed September structure indicate relatively limited pressures across the board.

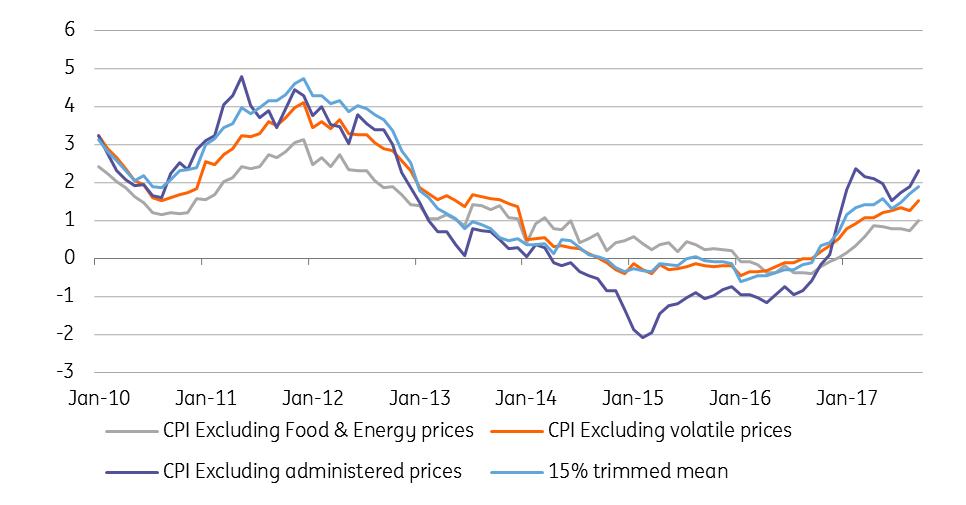

National Bank of Poland core inflation statistics

Core inflation still remains subdued yet gradual improvements occur

Overall we expect a benign reaction from the Monetary Policy Council (MPC), but the more significant impulse is likely to come from the National Bank of Poland (NBP) November inflation projection.

We expect increases to the 2018 wage forecast with limited tweaks to core inflation. Such revisions should calm centrist committee members including Ancyparowicz and Kropiwnicki and the interest rate hike discussion. We stick to our view assuming the first hike in 4Q18.