Poland’s economic growth set to deteriorate sharply

July data on industrial output, construction and retail sales surprised to the downside, signalling a deterioration in economic conditions towards the end of 2Q22. Annual GDP growth was probably close to 7% but is projected to decline sharply in the quarters ahead. Downside risks to our target rate of 8.5% have increased

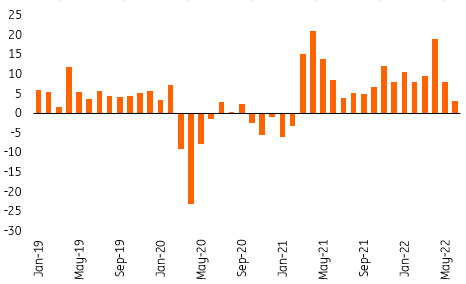

Retail sales growth decelerates

Retail sales rose 3.2% year-on-year in June (ING: 7.2% YoY; consensus: 5.9% YoY), following an 8.2% YoY increase in May. Increases were recorded mainly in sales of necessities (textiles, food, pharmaceuticals), supported, among other things, by purchases of refugees from Ukraine. At the same time, sales of expensive fuel and durable goods deteriorated further. Sales of goods fell 2.8% month-on-month in seasonally-adjusted terms. The deteriorating economic outlook, weak consumer sentiment, high prices and the expiring support from previously built-up savings are beginning to weigh on consumer spending.

Retail sales of goods, %YoY

Weaker construction data

In June, construction output rose 5.9% YoY, falling short of market expectations (around 11% YoY). This was the result of a markedly weaker increase in civil engineering construction than in May and a decline in specialised construction activity. Building construction, on the other hand, looked very good, with an increase of 15.2% YoY, following a 1.7% decline a month earlier. The StatOffice reported a 2.5% YoY decline in investment work and a high increase in repair work (20.1% YoY). Seasonally-adjusted construction fell 3.5% MoM.

The structure of the data is surprising. Rapidly deteriorating demand for dwellings (e.g. based on mortgage inquiries) suggests lower building construction, despite the favourable base effects of 2021. It is possible that contractors are speeding up work, fearing a further decline in demand and housing prices with the rising costs of materials. We are bearish on construction due to rising interest rates, regulatory changes (an increase in the buffer when assessing creditworthiness), and heightened uncertainty due to the war in Ukraine. In such an environment, the acceleration of housing completions may put downward pressure on housing prices.

In 2Q22 GDP growth near 7% YoY, but set to deteriorate sharply

The set of monthly data released today completes the economic picture for 2Q22. Industry, construction and trade all posted monthly declines in June in seasonally-adjusted terms. The same is likely to be true of 2Q22 GDP vs. the previous quarter, although there is still a chance of around 7% growth on annual basis. This is the last good quarter before a downturn, the symptoms of which were visible last month. Ahead lies a markedly worse second half while 2023 will be overshadowed by exceptionally high uncertainty.

MPC clearly less inclined to tighten monetary policy

The deteriorating economic outlook has translated into a marked easing of the MPC's course, despite persistently high risks to the inflation outlook. This means that the MPC will be cautious and switch to 25bp hikes. The odds of the National Bank of Poland's rate not reaching 8.50%, or getting there later than we expected, are mounting. The key risks are linked to CPI and prospects for the zloty.