Poland’s GDP up 2% in fourth quarter

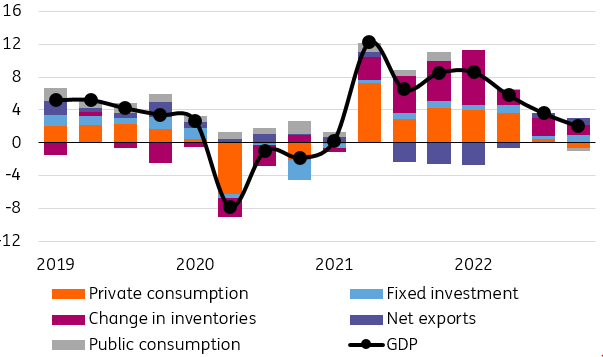

The preliminary reading of fourth-quarter GDP growth was confirmed at 2% year-on-year. The seasonally-adjusted data points to a 2.4% quarterly decline in economic activity, following a 1.0% increase in the third quarter. In annual terms, GDP growth was primarily driven by the change in inventories (+1.1pp) and net exports (+0.9pp)

Unexpectedly strong investment growth offset the negative impact of declining consumption. Gross fixed capital formation increased by 4.9% year-on-year, adding 1.0pp, while total consumption fell by 1.5% YoY knocking 1.0pp off the annual GDP growth rate.

Inventories and foreign trade drove growth in 4Q22

Domestic demand rose by 1.1% YoY, mainly due to the positive impact of inventory adjustments. High inflation is eroding households' real disposable income, which is translating into reduced consumption. Traditionally, in periods of slowdown, support for GDP growth comes from foreign trade. The positive contribution of net exports to GDP growth in the fourth quarter was the highest in more than two years. Import growth is decelerating faster than export growth. In the last quarter of 2022, exports of goods and services grew by 2.0% YoY, while imports advanced by 1.1% YoY.

GDP structure

Inventory growth is unlikely to continue

Domestic demand will remain weak in the coming quarters

The end of 2022 brought weakness in domestic demand, which will continue in the coming quarters, mainly due to subdued consumption. We forecast that the first quarter will bring a decline in GDP on an annual basis (down by about 1%) and the next two quarters will also be marked by sluggish growth. In 2023, economic growth will be mainly driven by an improvement in the real foreign trade balance. Low domestic demand will be further dampened by the negative contribution from the change in inventories. We are also concerned about the prospects for private investment, although investment activity should be supported by an increase in public investment due to the ending of the EU's 2014-2020 multiannual financial framework. According to the t+3 rule, funds must be used by the end of this year. At the same time, the prospect of accessing the Recovery Fund before the end of this year remains highly uncertain.

2023 GDP growth around 1%, but insufficient to significantly improve the inflation outlook

For the whole of 2023, we expect GDP growth in the vicinity of 1%, which until recently seemed an optimistic assumption. But the forecast is supported by improving global economic sentiment and less pessimistic expectations for the economic situation in Europe than seen earlier.

The structure of GDP growth (weak domestic demand) should support the widely-expected disinflation. At the same time, it is important to remember the large role of cost factors in generating inflationary pressure. Some of these have not yet fully fed into retail prices, although in an environment of weakening demand, transferring higher costs to prices will be more difficult.

Therefore, weakening domestic demand may not be enough to significantly reduce persistently high core inflation. In addition, a presentation of election programmes has been announced for the second quarter, which may bring pro-inflationary fiscal stimulus. In addition, the example of Hungary shows how inflation rebounds when administratively frozen prices are unleashed. So overall, we don’t see conditions for credible and justified rate cuts in 2023.

Also worth noting is the change in the GDP/inflation outlook in the US and eurozone. Financial markets have reduced expectations for rapid rate cuts in the US and Europe and upcoming data should show whether Federal Reserve and European Central bank hikes extend into the second half of this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Poland GDPDownload

Download snap