Poland: February data supports solid 1Q growth

Strong construction output suggests a further recovery in investment. We expect GDP growth close to 5% YoY in the current quarter

Industrial production slowed from 8.6% to 7.4% YoY in February, below market consensus (8.1%). Still, on a seasonally-adjusted basis, production accelerated from 6.2% in January to 7.3% YoY. Poland's statistical office GUS pointed to the strong performance of export-related sectors (manufacturing of machinery +20.8% YoY, electronics +10.8% YoY, furniture +10% YoY) and industries closely linked to construction (base metal production +15.6% YoY, non-metallic minerals including cement, concrete etc. +13,4% YoY).

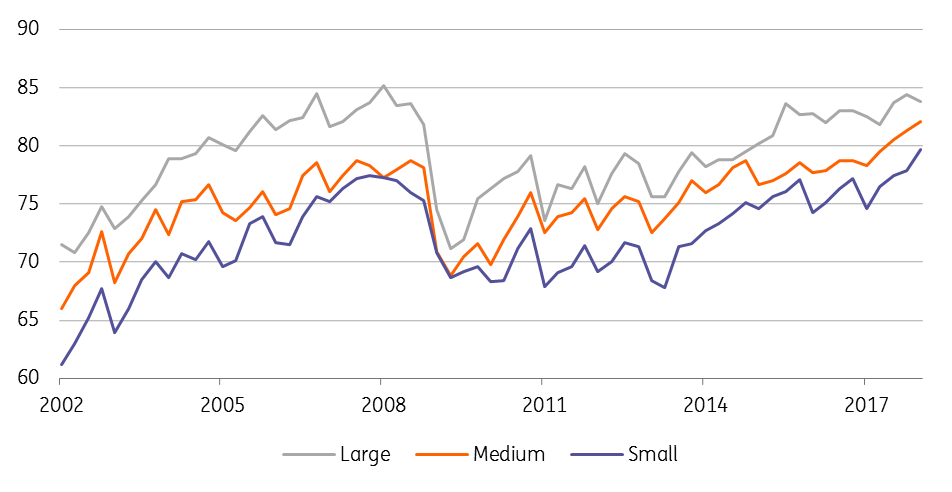

We expect robust activity to continue in the coming months as external demand is still solid (i.e. German orders are growing at a high rate). Domestically, sentiment amongst small and medium enterprises is also flourishing.

Solid external demand supports Polish manufacturing export sectors

SME manufacturing activity is improving

Construction output expanded by 31.4% YoY, above market consensus (29.8% YoY). Strong activity is related to infrastructural investment – civil engineering soared by 65% YoY, while construction for special purposes grew 31% YoY. Housing activity was robust at 12.1% YoY.

| 5.0% |

1Q18 GDP - ING forecast (YoY) |

Today’s data is consistent with GDP growth close to 5% YoY in 1Q18 (vs. 5.1% in the previous quarter). We expect investment to become a significant growth driver, maintaining double-digit growth (approximately 10.2% YoY vs. 11.3% YoY in 4Q17).