Despite Covid-19, Polish economy fares better than expected

So far, the second wave of Covid-19 has had a much milder impact on Polish economic activity. We expect the slowdown in 4Q20 to be much shallower than in 2Q20 and overall estimate that GDP will fall by about 2.8% in 2020

| -5.3% |

Retail sales in November YoYConsensus: 7.4% YoY decline |

| Better than expected | |

Polish retail sales fell by 5.3% year-on-year in real terms in November in comparison to the 2.3% YoY fall in October. The consensus forecast was a decline of 7.4% YoY, while our estimate was 6.5%.

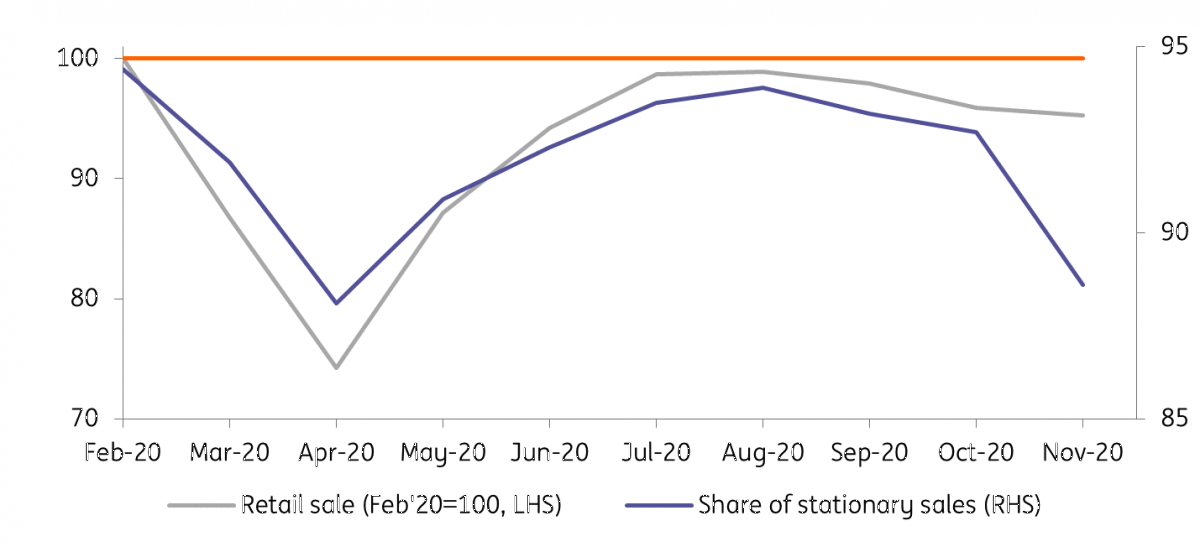

This is the third consecutive month of substantial sales decline and the seasonally adjusted level is almost 5% lower than the pre-pandemic levels. But having said that, the figures are still 20% above the April low, which will most likely be the case for a while. Our aggregating data index on administrative restrictions and population mobility indicated the same direction of sales.

In November, mobility restrictions were tightened again, which has meant the share of internet shopping rose to 11.4% compared to 7.3% in October, but it still remains below the levels seen in April. Despite the shift, internet shopping has not yet completely replaced brick-and-mortar shopping, and part of the shifting demand has been accompanied by a decrease in total sales volume.

Retail sales, the volume against the share of stationary sales

Sales dropped for all products - the highest for clothing (21.9% YoY) and fuel (14.7% YoY), which represents the warm winter and restricted mobility.

The smallest drop was in furniture, electronics and household appliances - only 0.6% YoY, although the scale of the deterioration was significant (from +11.9 YoY in October to -0.6% YoY in November). A relatively better standing in durable goods is an effect of shifting demand from inaccessible services.

The November drop in sales was only a quarter of the April figure, while the restrictions reached about ½ to 3/4 of the ones seen earlier in spring, which means customers are less afraid of contagion risks.

| -4.9% |

Construction and assembly production in NovemberConsensus was 5.2% YoY decline |

| Better than expected | |

The output of the construction and assembly production in November also performed better than expected dropping by 4.9% YoY compared to a market consensus of -5.2% and -5.9% in October.

November brought some improvement in this sector, including the group of specialised works. This, along with increased EU-funds payments, suggests an acceleration of infrastructure investments in the coming months.

November figures for the Polish economy suggest the industry has surprised on the positive side, the labour market remains strong and although retail sales were worse than October, they still surpassed market expectations.

The slowdown in the Polish economy in 4Q20 should be much shallower than in 2Q20

December should bring an improvement in most categories. Industrial output will be supported by a low base and calendar effects, while retail sales should improve as restrictions are eased and the additional trading Sunday in December.

The second wave of Covid-19 has so far had a much weaker impact on economic activity than the first wave. The slowdown in the Polish economy in 4Q20 should be much shallower than in 2Q20. We expect the GDP decline in 4Q20 to be less than 3% YoY, compared to -8.4%YoY in 2Q20.

Overall, we estimate that GDP will fall by about 2.8% in 2020, which is much better than our initial forecast and shows the economy has adapted.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

PolandDownload

Download snap