Poland: Dovish MPC guidance won’t curb hike expectations

The MPC reiterated its hike-averse stance, further supported by the new inflationary projection. But investors are likely to price hikes nonetheless, assuming the MPC will follow tightening by the ECB even next year

The Monetary Policy Council (MPC) left interest rates unchanged, in line with wide market expectations. The press conference highlighted a low propensity to hike interest rates. National Bank of Poland (NBP) Governor Glapiński said that if the NBP projection is correct rates should stay flat until 2020. The post-meeting statement was hardly changed compared to the previous meeting. The Council showed a weaker conviction in the investment recovery – in the current statement it only assessed it as possible.

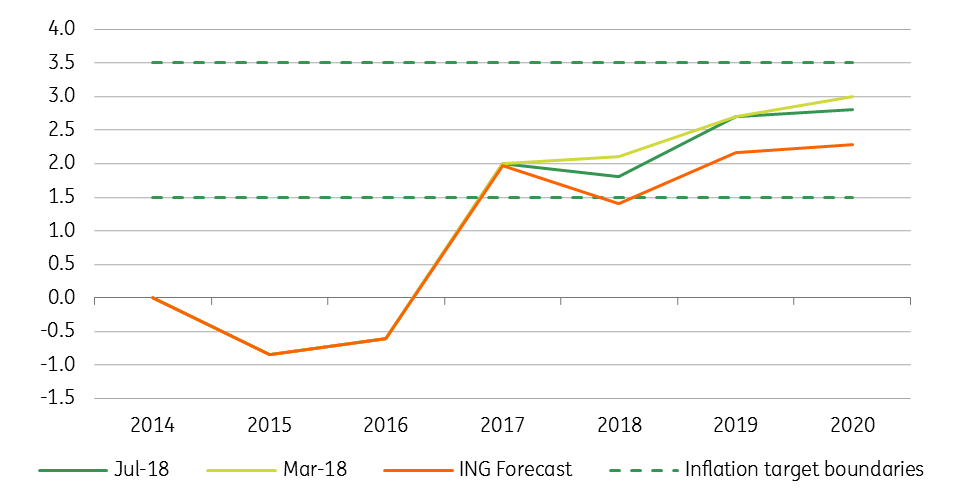

The scale of revision of the new projection was relatively small. The CPI path was lowered from 2.1% YoY to 1.8% YoY for 2018 and kept at 2.7% YoY for 2019. The projection was based on the assumption of core prices growth accelerating to 2.5% YoY. We remain sceptical on these numbers, particularly core acceleration. We forecast CPI at 1.4% YoY in 2018 and 2.2% YoY in 2019 with core inflation respectively at 1.1% YoY and 2.0% YoY (on average). Possible surprises will only harden the dovish MPC members’ stance. GDP projection revisions are less controversial – 2018 growth was pushed up after the very strong 1H18 figures (to 4.6% YoY from 4.2% YoY). The 2019-20 path was hardly altered.

Despite the very dovish MPC undertone, the market-priced rate hike path (currently 43bp within 24 months are priced) is unlikely to decline. During the press conference MPC member Ł.Hardt informed that the Council assumes no European Central Bank (ECB) rate shift until 2021. We and consensus alike expect a hike in 2H19. While this is unlikely to sway the Polish MPC into tightening (given low CPI and a shaky investment growth outlook), it will feed market expectations.

CPI (%YoY) - ING forecasts vs NBP projection

GDP (%YoY) - ING forecasts vs NBP projection

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap