Poland: CPI reaches central bank’s inflation target

Both CPI and GDP surprised on the upside contradicting the central bank's dovish rhetoric

| 2.5% |

CPI Flash reading(%YoY) |

| Better than expected | |

CPI

According to a flash estimate, CPI inflation accelerated to 2.5% year-on-year in November from 2.1%YoY a month earlier. Flash reading does not provide a detailed structure, but we think that prices of food and heating energy shaped the headline figure.

Both October and November present abnormally higher price increases of vegetable and fruits on agricultural exchanges and in retail markets compared to a typical seasonal pattern. Poland also faces problems with the supply of dairy and fat products especially butter and eggs.

We assume core inflation remained flat at 0.8%YoY with risks skewed to the upside. So far we've seen somewhat limited inflationary pressures even in prices of services typically more dependent on wages. Furthermore, motor vehicles created a significant drag, possibly due to cheaper diesel cars imported to Poland. And that seems unlikely to revert in the coming months.

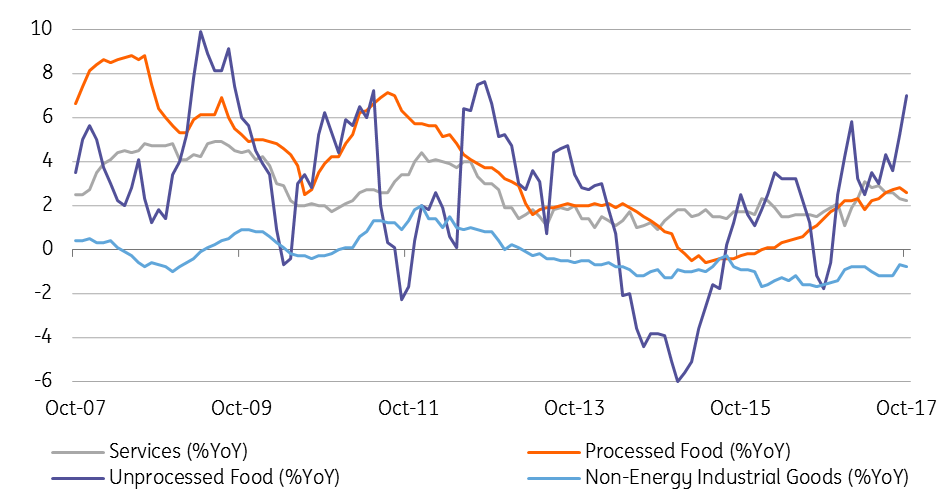

HICP inflation - selected components (%YoY)

| 4.9% |

3Q17 GDP(%YoY) |

| Better than expected | |

GDP

The second estimate for 3Q17 GDP was revised to 4.9%YoY compared to 4.7%YoY according to a flash estimate.

The main driver of GDP growth remained private consumption with stable 4.9%YoY growth. Gross fixed capital formation surprised us again negatively with moderate recovery from 0.8%YoY to 3.3%YoY reflecting mostly statistical base effects rather than structural improvement.

So far we see improved local government expenditures contributing to a rebound in public investments. On the other hand, outlays of bigger companies remain soft with a strong negative drag from mining and the energy sector. Finally, superb production performance resulted in the greater surplus from net export (+1.1pp) while the contribution from inventories remained neutral.

Short term perspectives remain optimistic. We expect 4Q17 figure to achieve 5%YoY dynamics. Industrial production should accelerate further to 8%YoY vs 6.4%YoY quarter ago supporting next exports and consumption. Also, investment recovery is likely to accelerate, and the realisation of EU cofounded projects is likely to remain relatively soft.

GDP structure (%YoY)

MPC reaction

Today’s CPI releases contradicts the MPC's dovish rhetoric.But a shift in the stance of centrist members would require a rather broad-based acceleration of a great majority of categories constituting core inflation.

Final release (published in the next two weeks) should bring strong attention, yet we expect a rather limited impact on monetary policy. It is also worth mentioning that both doves and centrists seem worried about investment performance and rather downplay recent wage dynamics increase highlighting rather a weak link between wages and core inflation. Both factors should limit propensity to policy tightening.

So far we see four of six members required supporting interest rate hike in 1H18 (L.Hardt, K.Zubelewicz, E.Gatnar and J.Osiatynski). All in all, we still see a rate hike in 4Q18 as the most likely option, with the risk of earlier increase.