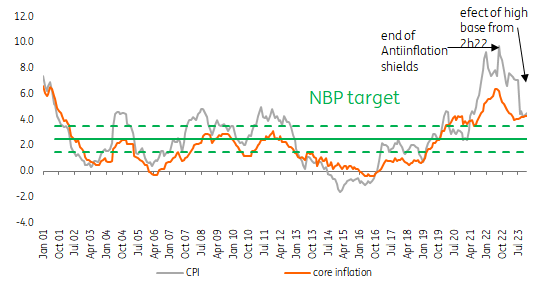

Inflation in Poland to remain elevated

Anti-inflation measures should temper a peak in CPI in 2022, but rising costs, strong consumer demand and a tight labour market mean elevated inflation will persist

The flash estimate of Poland's inflation for December 2021 was up 8.6% Year-on-Year. The price of consumer goods (the Consumer Price Index) jumped by 9% YoY, while the price of services increased by 7.6% YoY, compared with 8.1% and 6.6% respectively in November.

Annual inflation increased between November and December primarily due to the sharp rise in food and non-alcoholic drinks prices (8.6% YoY vs. 6.4% YoY). That category was responsible for a 0.6 percentage point jump in annual CPI inflation compared with the previous month. According to our estimates, the remaining 0.2 percentage point was generated by a further climb of core inflation that hit some 5.3% YoY at the end of 2021.

CPI and NBP rates in Poland

The robust growth of food prices (2.3% Month-on-Month) stemmed from broad-based increases in many food products. A sharp rise was observed in the case of bread and flour, meat (particularly poultry and beef), fruits and vegetables as well as fats (including butter). Interestingly enough, the StatOffice reported only slight declines in the price of gasoline and diesel as well as higher LNG prices, despite cuts in excise duty in the last decade of December, which creates a high reference base for the monthly change in January this year. Further buoyant price growth took place in restaurants and hotels.

The current upswing in inflation is broad-based. Clothing and footwear, among the main components of CPI baskets, saw price growth below 3%. Prices in this category have declined in annual terms for the last 10 years. High inflation pressure is generated by energy (electricity, gas, heating, gasoline, diesel), which was about 20% more expensive than in December of 2020. This starts feeding into the prices of other goods and services.

The extension of the so-called Anti-inflation Shield 1.0 in time and its expansion in size (shield 2.0) will flatten the inflation path in the first half of 2022, but the reversal of VAT rates to its starting levels may generate a local peak of inflation that could even reach double-digit levels. In this context, some measures introduced by shields may be prolonged, and authorities may decide to diversify the return to base 23% VAT rates for particular goods. Policy actions will be driven by the condition of public finances and net price developments of goods being subject to temporarily lowered VAT rates.

We project that in 2022, annual average price growth will be slightly above 8% and CPI inflation will still remain elevated in 2023 (~6%).

We are far from simply concluding that the entire price growth in Poland stems from supply-side shocks. The shock coincided with already buoyant consumer demand and a tight labour market, which makes it easy for enterprises to pass higher costs onto final prices. On top of that, labour market conditions pose a risk for a wage-pressure spiral. In our view, we currently observe an autumn-winter wave of supply-side shocks (natural gas, coal, oil and food) that, similar to what we saw in the first half of 2021, will be followed by increases in retail prices in response to higher costs (second-round effects). This is possible because there is no significant demand barrier. We believe that anti-inflation shields should temper the CPI peak in 2022, but rising costs, strong consumer demand and a tight labour market should make elevated inflation persistent.

This means that there is still sizable scope for monetary tightening, and at February's Monetary Policy Council meeting National Bank of Poland (NBP) rates will be hiked by at least 50bps. At the last press conference, NBP President Adam Glapiński stated that the policy rate at 3% would not pose a threat to the economy, and in the scenario of robust economic growth, rates could go up even to 4% (our baseline scenario for 2022). The persistency of elevated CPI (even if off the peak from 2022) is an argument for hikes in the second half of this year and in 2023, where we see rates reaching 4.5%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap