Poland central bank sounds ultra-dovish and postpones hikes

The new projections revisions were in line with our expectations causing major softening of MPC language. We now reduce our hike expectations in 2019 to 25bp

The Monetary Policy Committee (MPC) decided to leave rates flat at 1.5% as widely expected.

The key takeaway from March MPC meeting was how the Council bias has changed after the National Bank of Poland updated its macroeconomic projections. The strong GDP dynamics and rise of wages in 4Q17, as well as some unfortunate comments of governor Glapinski in Davos, have all raised hike expectation in 2019 to 70bp in the peak.

But since then they subsided to about 62bp before the today's MPC meeting and to about 50bp after the ultra-dovish press conference.

Today, the MPC swang to an ultra-dovish bias was even more aggressive than our non-consensus expectations presented in our MPC preview.

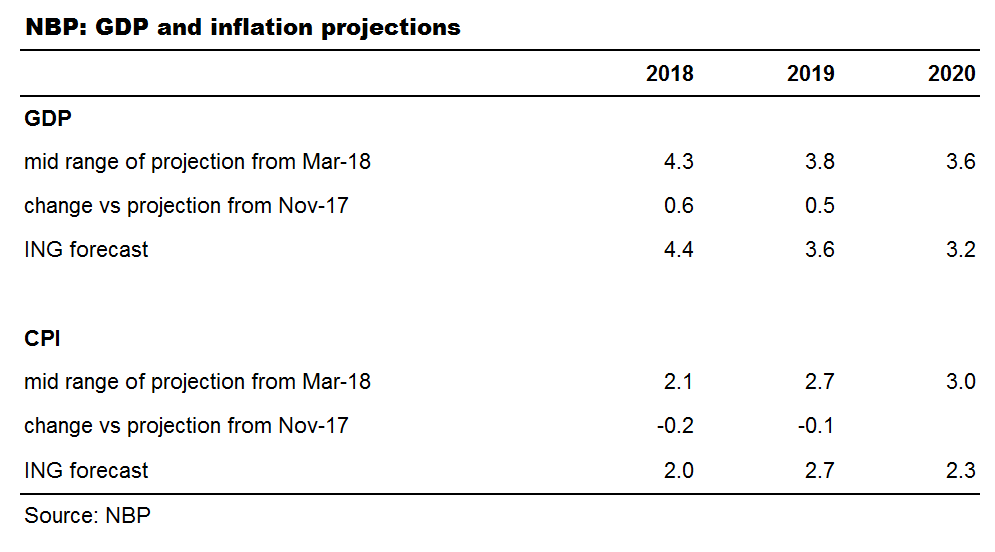

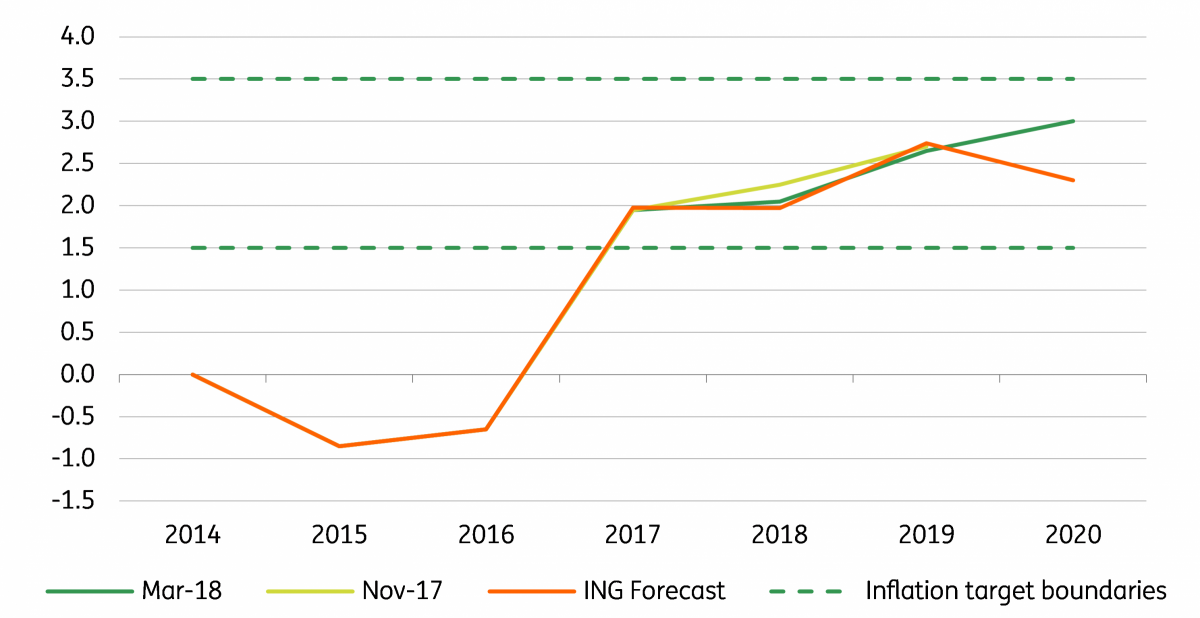

The MPC press release points the following revisions of NBP expectations: 2018 CPI projection 0.2 down and for 2019 0.1pp down. That all taken place despite expected GDP growth for 2018-19 was revised up by 0.5-0.6pp. The MPC statement sounds upbeat on economic growth but still holds unchanged conclusion that “inflation will remain close to the target over the projection horizon”.

| 25bp |

ING forecast - NBP rate increase in 2019Revised from 50bp |

NBP Governor Glapiński (about rate hikes): 2018 is unlikely, 2019 – really don’t know, maybe in 4Q19 or not at all. Even 2020 doesn't make sense to tighten, maybe we will reach a point when we will discuss cuts

The most interesting was the press conference which delivered a significantly more dovish tone in comparison to last month.

NBP governor changed his forward guidance on rates and postponed expected tightening to 4Q19 or even 2020. Last month, a rate hike was alluded to in the first half of 2019.

When asked about the timing of hikes NBP governor Glapinski answered: “2018 is unlikely, 2019 – really don’t know, maybe in 4Q19 or not at all, even 2020 does not make sense to tighten, maybe we will reach a point when we will discuss cuts”.

As a result, revise our rate hike expectations in 2019 from 50bp to 25bp.

NBP: CPI projection vs. ING forecasts (%YoY)

NBP: GDP projection vs. ING forecasts (%YoY)

NBP Projections - Forecast Summary