Polish GDP grows by 5.1%YoY in the fourth quarter; we remain upbeat

Finally, investment in Poland recovers to make a higher contribution (2.8pp) than consumption (2.4pp). We remain upbeat for 2018 and forecast 4.5% GDP growth

The fifth time in a row we're close to 1% growth, Q-on-Q

Polish GDP growth in the fourth quarter of 2017 came in at 5.1% year-on-year, higher than the 4.9% we saw om 3Q17. It's the fifth time in a row we're close to 1% growth quarter-on-quarter. That's all according to the first full estimates. The key GDP component is the long-awaited recovery in investments. They grew by 11.3%YoY vs. 3.3%YoY in 3Q17, close to our rough estimates based on the full-year GDP release. With that in place, the structure of economic growth looks increasingly healthy.

Contrary to previous quarters when consumption was responsible for 60 to 70% of GDP in 4Q17 the investment recovery was strong enough to have made a higher contribution (2.8pp) than consumption (2.4pp). Private spending grew by 4.9%YoY, still very robust and in line with the previous three quarters of 2017. The inventories contribution turned negative (-0.3%pp in 4Q17) after many quarters of growth. Also, net exports had a negative impact (-0.8pp), but this is hardly surprising given the strong rise of investments which fuels imports much more than private spending.

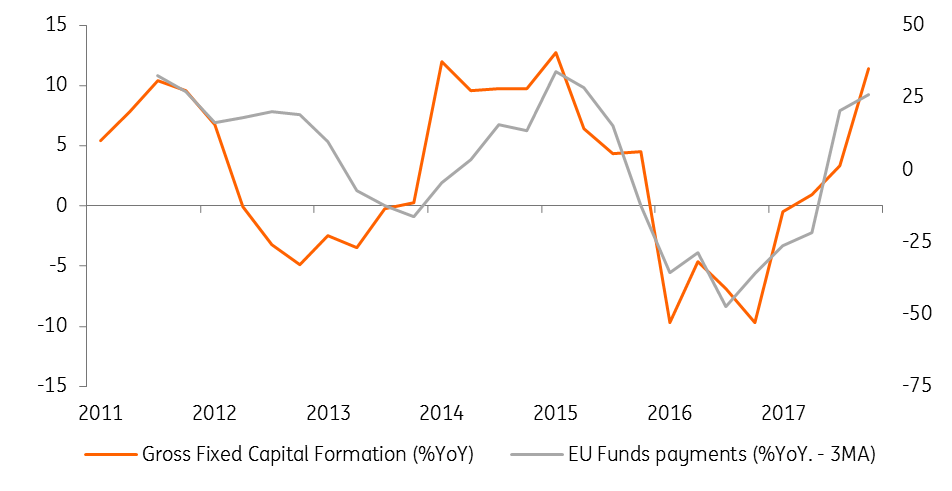

Still, the strong investment rise in 4Q17 is to a large extent a statistical phenomenon as we compare this to the exceptionally weak 2H16 when there was a trough in EU money paid. 2018 will actually be the year when not only dynamics but also nominal investment spending should remain solid.

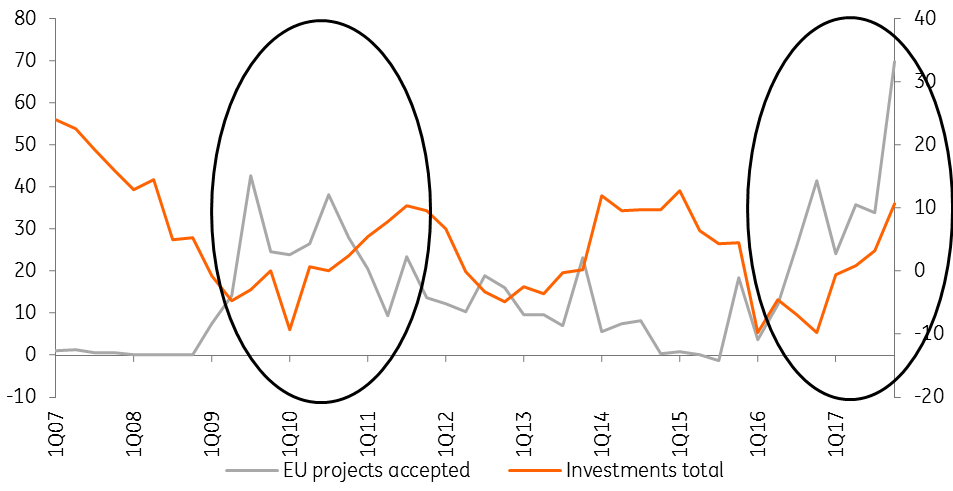

EU project accepted and Investments (%YoY)

Strong number of accepted project support public sector investment acceleration in 2018,

EU funds paid and investments (%YoY)

3 reasons we're optimistic

Looking ahead we remain optimistic on 2018 growth – we expect 4.5%YoY given that:

- Investment acceleration to take a lead: This should be fuelled by public outlays partially funded by the EU money (PLN278bn of EU funds were contracted), but also private projects; the actual payments of EU funds remained subdued in 2017 (PLN30.5bn vs 27bn in very soft 2016), yet slightly accelerated in 4Q17 and should remain so in coming quarters.

- Solid consumption: Despite fading fiscal impulse (child benefit) the 8.5% YoY dynamics of wages and finally some more leverage of households should keep their spending growth elevated

- Supportive global sentiment: This should imply a positive and strong net export contribution.

What next for the Polish central bank?

The Monetary Policy Committee seems to welcome strong GDP dynamics (with an improving investments contribution). So long as unit labour costs remain subdued there is no rush to hike. The Council representatives signal they remain alert with regards to 2019 as hikes may appear next year, but the short-term outlook (as in 2018) is less burdensome than a few months ago.

The data from 2H17 shows higher GDP investments and wages than the Polish Central Bank was expecting, but lower core CPI. Moreover, we think the weaker dollar, subdued Eurozone core and still robust productivity dynamics should let core inflation accelerate gradually, from 1%YoY now to about 2% at the end of 2018. That means the new NBP projections, released in a week's time should present lower average core for 2018 than the NBP visualised during the previous forecasting round. The headline CPI for 2018 may be close to the 2%YoY average in 2018, so slightly lower what the NBP expected before (2.3%YoY). That should make MPC hawks and some swing voters less worried.

4Q17 GDP - summary table

MPC on 'alert mode'

Overall, the tone of the press conference (next week) should still be dovish, although the MPC may say it is in 'alert mode', as 2019 hikes are on the table but probably not as many as the market is pricing now (ie. 75bp in 2019). We don’t think MPC bias will turn more hawkish soon, as some expect. This should definitely not happen during the March meeting and the new set of projection should calm down the MPC hawks for some time.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap