Poland: 2017 GDP surprised on the upside (again)

At 4.6%, Poland's annual GDP growth beat the consensus estimate and was in line with our forecast, driven by strong investment. We expect robust activity to continue in 2018, with growth of at least 4.4% YoY

Poland's flash annual GDP figure came in at 4.6%YoY, slightly above the market consensus (4.5%YoY) and in line with our forecast. Private consumption was a major contributor in 2017 (rising 4.8%YoY and adding 2.6pp to the headline figure). Fixed capital investments recovered after a sharp decline in 2016 and grew 5.4%YoY (contribution of 1pp). Finally, net exports and inventories added minor positive contributions (at 0.1pp and 0.2pp, respectively).

| 11.4 |

Estimated investment growth in 4Q17 (%YoY) |

Based on the full year GDP figure, we estimate 4Q17 GDP growth at 5.2%-5.3% YoY in line with our expectation of above 5% GDP growth. The recovery of investment was better-than-expected, likely due to greater local government spending – annual data suggest that in 4Q17 investment grew 11.4%YoY vs. 3.3%YoY in 3Q17. Private consumption also surprised positively with strong 5%YoY growth. On the other hand, the contribution of net exports was below our expectation of close to zero.

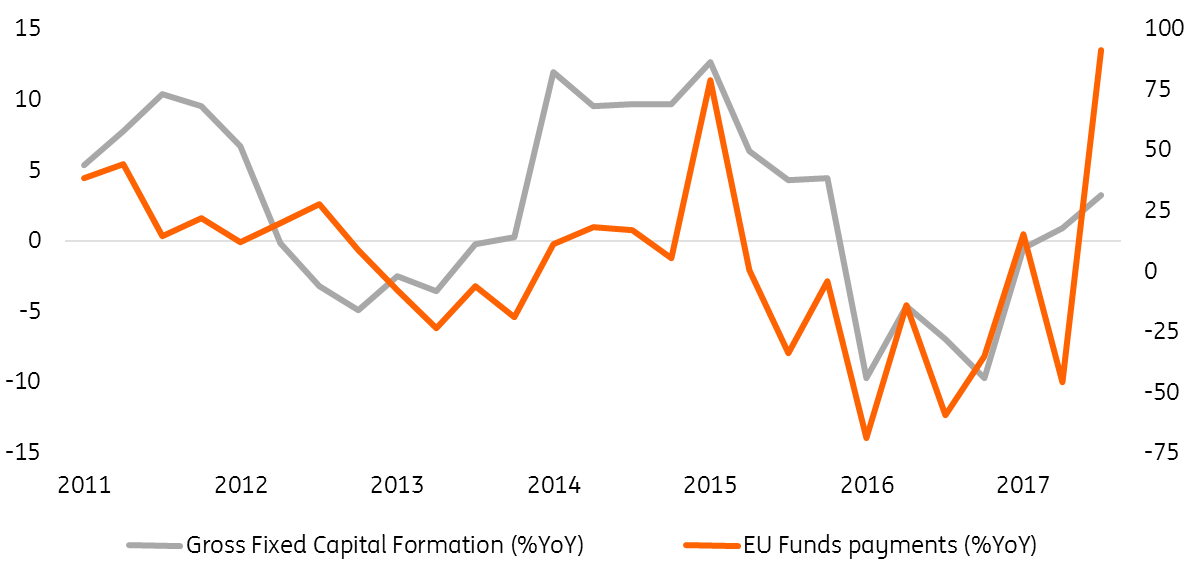

Investment acceleration supported by EU funds

Looking ahead, we remain optimistic on 2018 growth – we expect at least 4.4%YoY growth due to:

- acceleration of investment (including a strong rise in EU funds)– so far PLN165bn of EU funds were contracted with a sharp acceleration in December 2017. The payments remained subdued in 2017 (PLN30bn vs 27bn in a very soft 2016), yet the increase should occur this year.

- solid consumption, despite the fading fiscal impact from the introduction of the child benefit programme. Labour market conditions remain supportive – double-digit growth of corporate wages in 2018 seems likely in some months (on average 8.5%YoY) as shortages of both skilled and non-skilled workers intensify.

- supportive global sentiment, signalling a positive and strong contribution from net exports.

The MPC seems to welcome strong GDP growth as long as unit labour costs remain subdued. The key element for the MPC is the acceleration of these costs. Sound GDP growth in 4Q17 means that productivity has caught up with wages, so the MPC will likely remain dovish. We moved the first MPC hike to 2019 due to the strong rise in productivity in 2H17, which helps contain unit labour costs and offsets wage increases. We see a CPI risk in 2019 when we expect the MPC to begin the tightening cycle.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap