Poland: 12-month current account balance posts monthly deficit for first time in two years

Poland’s current account and trade balances continue to deteriorate quickly. Imports are driven by strong domestic demand and higher energy bills, while export growth is constrained by the shortage of microprocessors. As a result, Poland’s trade balance in the automobile sector is shrinking

The current account deficit in October amounted to €1.7bn – significantly above the consensus (€1.2bn) and our forecast (€0.9bn). This outcome was a result of a trade deficit amounting to €0.8bn, a significant surplus in services (€1.7bn), a sizeable deficit in primary income flows (€2.3bn), and a deficit in secondary income of €0.3bn. The difference in the growth rate of merchandise imports (20.4% year-on-year) and exports (6.6%) increased from 9.2ppt in September to 13.8ppt in October.

Import bills keep on growing strongly due to a recovery in domestic demand and record-high energy prices. Export opportunities are constrained by disruptions in global supply chains, which are particularly affecting Germany - a destination for almost 30% of Poland’s exports.

According to the National Bank of Poland's commentary, import dynamics was driven by the high price of fuel, including natural gas, oil and oil refinement products. Imported processed goods also expanded quickly, especially metals and chemical products. Shortages of semiconductors had a negative impact on the automotive sector. The NBP pointed out that – on the export side – a decrease was recorded in all types of road vehicles and car parts. Given that the share of the automotive industry is greater in Polish exports than in imports, the crisis has led to the trade balance worsening in this sector.

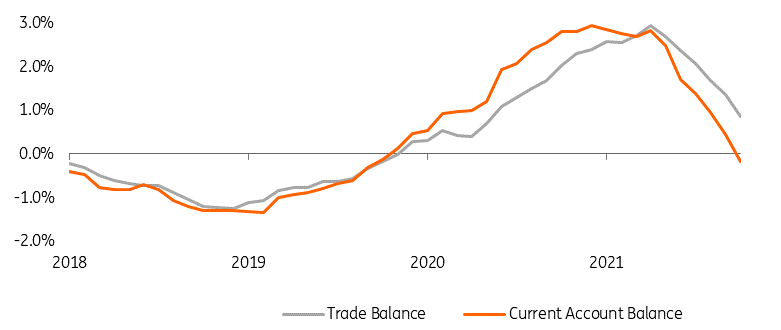

As a 12-month cumulative, we estimate that the current account balance has shifted from a surplus of 0.4% of GDP in September to a deficit of 0.2% of GDP, while the trade balance has deteriorated accordingly, from 1.4% of GDP to 0.9% of GDP. The 12-month CAB posted a monthly deficit for the first time since October 2019. Assuming a continued economic recovery and high energy prices, we expect a further deterioration of both balances. We estimate that the trade balance will reach 0 (zero) while the current account deficit may reach 1.5% of GDP. In the pandemic of 2020, both balances recorded significant surpluses, of 2.4% and 2.9% of GDP, respectively.

The fast deterioration of the current account balance in 2021 is not supportive for the zloty. At the same time, the evaporation of external surpluses is an increasingly relevant point for MPC decisions on interest rates.

Current account and trade balances, as % of GDP

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap