Philippines: Trade data continues to point to drawn out economic slump

Philippine trade data for May showed both imports and exports cratering, down by 40.6% and 35.6% respectively. The narrowing of the trade deficit means should be supportive of the strong-peso for now, but it also highlights that the economy is headed for a protracted slump

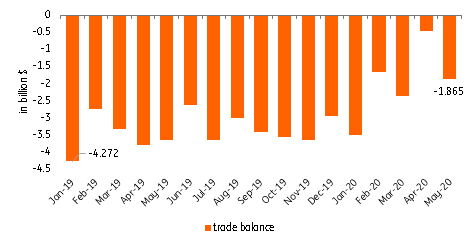

| -$1.87 |

Trade balanceLower than the 2019 average of -$3.3 bn |

Slumping trade points to slowing economic momentum

The ill effects from the Covid-19 induced lockdowns continue to surface with trade data for May showing yet another month of steep contractions for both exports and imports.

Exports were down 35.6% - the third month of double-digit losses with global demand for exports slowing to a grind. Imports collapsed too, down 40.6% with more than two-thirds of the Philippine economy on strict quarantine measures, which points to lower potential output in the coming months as the country cuts back on imports of capital machinery (-37.7%), raw materials (-31.3%), fuel (-80%) and consumer-related goods (-37.6%).

Philippine trade balance

Trade deficit remains below 2019 levels, positive for PHP

Although the trade deficit posted in May was wider than anticipated (median forecast at -$500 mn), the -$1.87 trade balance was well below the 2019 average of -$3.3 bn.

The narrowing of the trade deficit was driven in large part by import compression translating into anaemic demand for the dollar with corporations looking to hold on to peso liquidity given the uncertainty. The bleak economic outlook means that most investors are likely to shelve capital-intensive plans for the time being or until economic conditions improve.

We expect the trade balance to remain in deficit but not around the 2019 levels of more than -$3bn, which will likely translate to an improvement in the current account balance.

This development will be supportive of the strong-peso for now, but it also highlights fading potential output which could mean that the Philippine economy his headed for a protracted economic slump.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

10 July 2020

Good MornING Asia-13 July 2020 This bundle contains 4 Articles