Philippines’ remittances grow by 9.3% despite second lockdown

Overseas Filipino remittances bounced back by 9.3% in September after dipping in August. But despite the sharp swings seen in remittance flows this year, we believe they will end up about 5% lower for the year, given the large number of migrants losing their jobs in host countries

| 9.3% |

Overseas Filipino remittanceGrowth |

| Better than expected | |

September remittances up 9.3%

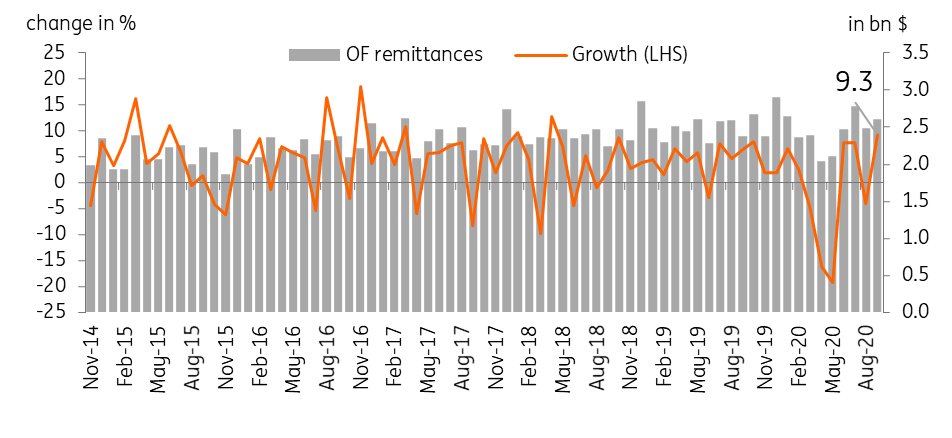

Philippines overseas remittances grew by 9.3% in September, while the expectation was -4.3%. After falling by 4.1% in August, this rise is probably due to the rise in migrants sending savings prior to repatriation and the temporary reopening of economies post lockdown.

For the year, Filipinos based abroad sent home a total of $21.9 bn, down 1.4% compared to the same period last year with the central bank expecting remittances to dip by less than 2% for the year. Remittances from land-based migrants, which comprise up to 75% of the total, sent home 10.2% more remittances while sea-based migrants posted their first increase in five months, up 6.5% as global trade picked up after the strict lockdowns in 2Q across major markets.

Overseas Filipino remittance levels and growth

Remittance flows likely to be choppy but lower on average

Overseas remittance flows have swung between gains and contractions in the past few months with lockdowns across the globe and the slowdown in global trade affecting remittances negatively.

We’ve also noted that some overseas Filipinos set for repatriation are likely to send their entire life savings home ahead of their return, which may have caused a one-off surge in remittances in the past few months. Despite these sharp swings, we believe remittance flows may end up about 5% lower for the year with up to 300,000 overseas Filipinos repatriated to the Philippines after job losses in their host countries.

Meanwhile, renewed lockdowns in parts of Europe and the US will likely delay the economic and trade recovery, which will, in turn, have an adverse impact on remittance flows in the near-term. The September surprise, however, will be positive for the currency in the short-term but we do not expect this development to affect the central bank's stance which meets on Thursday to decide policy.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

PhilippinesDownload

Download snap

16 November 2020

Good MornING Asia - 17 November 2020 This bundle contains 5 Articles