Philippines: Inflation marches higher but BSP signals no change

Philippine inflation accelerated in February, rising to 4.7% due largely to a pickup in food prices

| 20.7% |

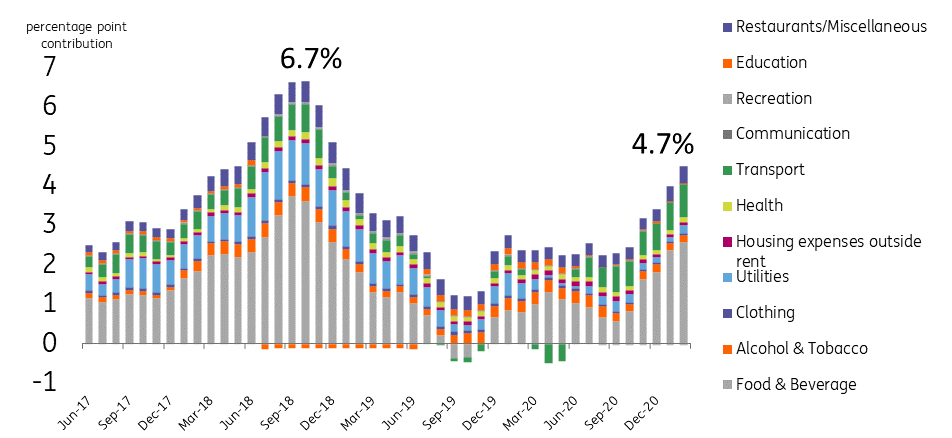

CPI inflation for meat itemsMeat prices push food inflation to 6.7% |

February inflation accelerates to 4.7%

Inflation heated up again in February, rising to 4.7%YoY with food supply chains challenged by the African Swine Fever (ASF) and recent storm damage. The ongoing ASF episode forced meat prices, which account for roughly 6% of the CPI basket, to surge by 20.7% while fruits and vegetables (+16.7%) remained pricey due to crop destruction from a spate of typhoons late last year. Transport costs (+10.4%) also pushed the headline reading higher due to the pickup in global crude oil prices and in large part due to costs associated with Covid-19 related health guidelines. Food and transport inflation contributed 3.4 percentage points to the headline total of 4.7%, highlighting that the recent breach is caused by a few specific index-heavy components. Meanwhile, recreation and leisure activities remained in deflation (-0.7%) as demand side pressures remain largely absent due to the ongoing pandemic.

Philippine inflation driven by two key components: food and transport

Second month of inflation breach but BSP to stay on the sidelines

Bangko Sentral ng Pilipinas (BSP) Governor quelled concerns about a possible policy rate hike in the near-term, highlighting the supply-side nature of the recent surge in prices. Diokno however did indicate that monetary authorities were on the lookout for signs of second-round effects (wage or transport fare adjustments) and if the recent spike in prices could affect the inflation outlook over the policy horizon. In the meantime, Diokno does appear confident that inflation will eventually taper off in the second half of the year once direct supply-side remedies to food supply shortages take root. We expect BSP to remain sidelined for 2021 while inflation will likely remain elevated in the near-term before gradually decelerating by the 3Q. The PHP will likely move sideways as Diokno suggests that a rate hike is not on the table for now.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap