Philippines: Inflation flat at 4.5% in May, downtrend expected in second half of 2021

Philippine inflation was steady at 4.5% as higher gasoline prices offset decelerating food inflation

| 4.5% |

May CPI inflation |

| As expected | |

Move along, no surprises here

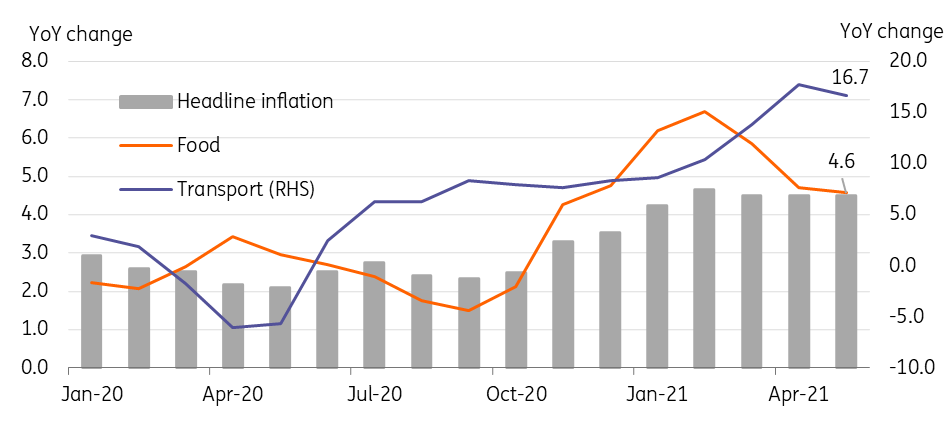

Philippine inflation was steady at 4.5% YoY, in line with market consensus as higher transport prices offset decelerating food inflation. May marks the 5th month inflation has stayed above the central bank’s 2-4% inflation target with the usual suspects of food and transport costs keeping the headline reading elevated. Food inflation decelerated to 4.6% (from 4.8%) as prices for corn and fruit fell due to improved harvest conditions. But stubbornly high pork prices due to the African Swine Fever (ASF) outbreak kept food inflation above 4%. Transport inflation also remained high, posting a 16.5% increase from the same month last year as retail gasoline prices and public transport fares for tricycles rose 33.0% and 38.8%, respectively. Meanwhile, soft domestic demand was noted in negative inflation readings for recreation and cultural activities as households cut back on non-essentials as incomes remain constrained.

Higher transport costs offset slowing food inflation

See you next year? No changes from BSP expected until mid-2022

Central Bank (BSP) Governor Diokno recently signalled that he was willing to do more to bolster the economic recovery but reiterated that his current stance was appropriate given the steep pullback in economic activity. Diokno quickly quelled any notion that a reversal in policy stance was in the offing, indicating that accommodative monetary policy would be in place until at least 1H 2022. Above-target inflation constrains Diokno from cutting policy rates further while the disappointing 1Q GDP reading is likely enough to convince Diokno that rates should stay where they are for now. With bank lending in negative territory for 5 months and counting, it’s clear that the banking sector is still in need of stimulus from monetary authorities. Inflation will likely decelerate in the coming months as supply conditions ease with inflation set to return within target by as early as July. We expect BSP to extend its pause for the balance of the year while pencilling in a possible rate hike by 3Q 2022 as economic conditions improve.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap