Philippines: Inflation climbs to 2.9% as food costs rise

January inflation inched higher to 2.9% as crop damage from twin storms and a volcanic eruption caused supply disruptions.

| 2.9% |

January inflationfastest in 8 months |

| Higher than expected | |

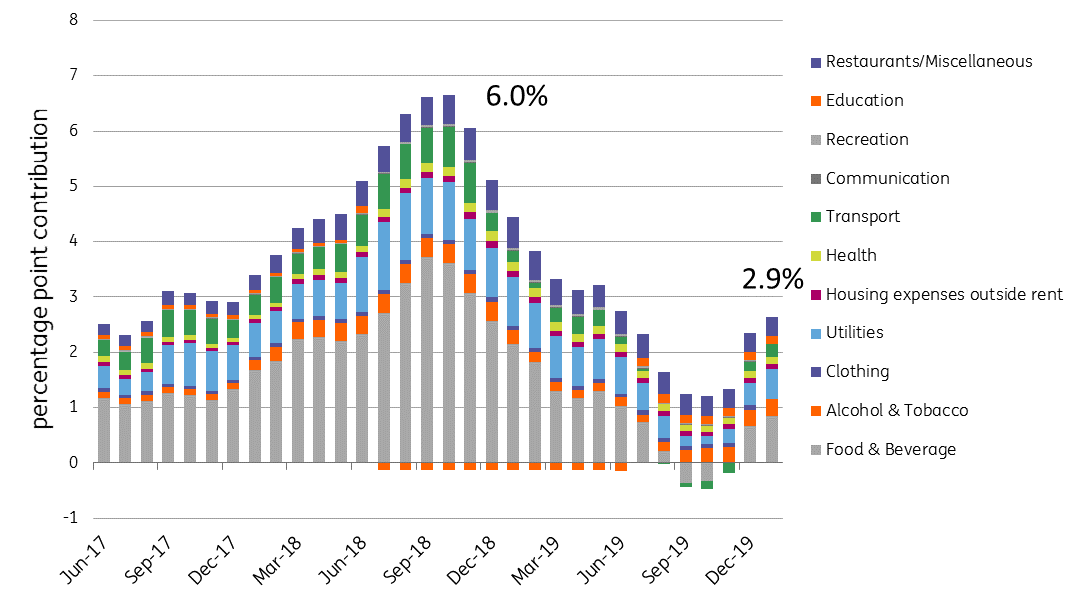

Food inflation continues to be the main driver for headline inflation

January inflation climbed to 2.9%YoY, moving past market expectations (2.7%) with higher food prices pulling up the overall headline number. Almost all subcomponents of the consumer price index (CPI) posted faster inflation, but the main driver for the recent uptick in inflation remains food, given its heft in the CPI basket. Food inflation hit 2.9%, up from 2.5% on runoff effects from crop damage induced by twin typhoons in late 2019 and the 2020 volcanic eruption. Meanwhile, excise taxes levied on alcoholic beverages and fuel items pushed up prices for transport (3.0% from 2.2%) and alcoholic beverages and tobacco (19.2% from 18.4%).

Philippines inflation (percentage point contribution per component)

BSP expected the “uptick”, as reverse base effects kick in

Bangko Sentral ng Pilipinas (BSP) Governor Diokno indicated that they are fully expecting an “uptick” to inflation and that risks to the inflation outlook are tilted to the “upside”. We also expect inflation to inch higher and “bounce then settle” as reverse base effects from the 2019 inflation lows nudge prices higher in 2020. Meanwhile, risks noted by the BSP are trade war disruptions to the supply chains. For the full year, ING still expects inflation to remain within target and average 3.2% but peaking in 3Q.

BSP to cut policy rates on Thursday

Despite the uptick in inflation, we expect the BSP to cut policy rates by 25 bps at the 6 February meeting with the BSP 2020 inflation forecast pegged at 2.9%. Given the backdrop for slowing global growth, upside risks to the inflation outlook are dampened considerably with crude oil prices tanking on expectations for weaker global growth and depressed oil demand from China. With inflation still expected to remain within target and as global growth is likely to be hampered by the spillover effects from the recent 2019-nCoV episode, we expect the central bank to resume unwinding its previous policy tightening to bolster growth momentum and chase the 6.5-7.5% growth target.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

5 February 2020

Good MornING Asia - 6 February 2020 This bundle contains 5 Articles