Philippines: Inflation breaches target in January but BSP not likely to react next week

Philippine inflation breached the central bank’s target in January with cost side pressures on full display.

| 4.2% |

January inflation |

| Higher than expected | |

Breach!

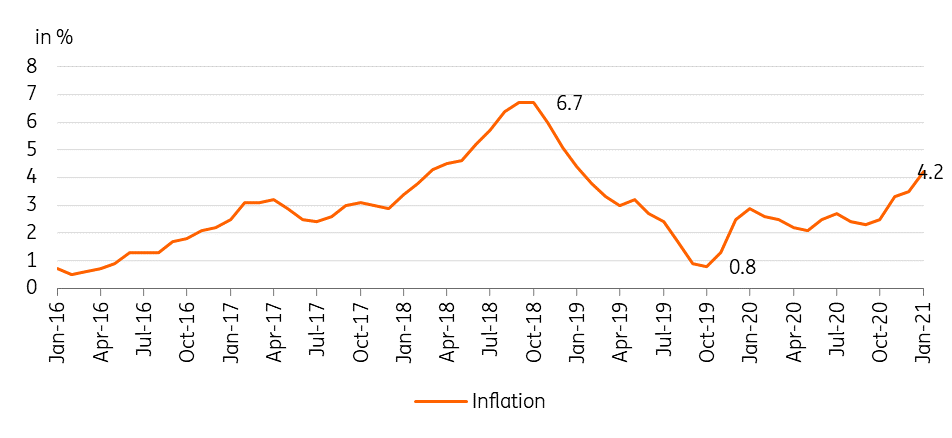

Philippine inflation surged to 4.2% in January, breaching the central bank’s 2-4% inflation target band due largely to surging food prices (6.2%) and a pick up in transport costs (8.6%). A string of destructive typhoons in late 2020 caused supply disruptions that pushed vegetable and fruit prices higher while the spread of African Swine Fever (ASF) triggered a sharp run-up in pork and other meat products with supply greatly affected by the disease. Meanwhile, the recent rise in global crude oil prices nudged transport costs higher with retail gasoline outlets raising prices at the pump on a weekly basis in January. This was the first breach since 2018 when inflation surged to a high of 6.7% driven also by rising food prices and higher transport costs. We expect inflation to remain elevated in the coming months with base effects and persistent cost side pressures to keep the headline close to or above the 4% level.

Philippine inflation breaches central bank target in January

BSP expected to stand pat despite inflation surge

Despite the surge in inflation, we do not expect Bangko Sentral ng Pilipinas (BSP) to adjust its policy stance at their policy meeting next week given the fragile state of the economy, with 1Q 2021 GDP expected to remain in contraction. BSP Governor Diokno will likely look past the inflation breach given that cost side factors were the main driver and after President Duterte ordered price caps on pork and other meat products, while also increasing pork imports to help augment domestic supply. We expect BSP to refrain from adjusting policy in the near term as Diokno provides monetary support to the economic recovery with monetary authorities hoping to ride out this latest breach until supply conditions normalize in the coming months.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap