Philippines: Exports post strong gain but imports show more modest growth

Resurgent demand for electronics helped power the exports sector while imports saw a less robust expansion

| $3.6bn |

February trade deficitThe Philippines |

| Better than expected | |

Exports jump 15.7% while imports rise 6.3%

February trade data showed a strong bounce for exports, rising 15.7%YoY, largely on the back of the mainstay electronics subcategory. Electronics comprise more than half of total exports, and the 26.8%YoY jump in outbound shipments was enough to lift the overall headline number past 15%YoY. The surge in electronics shipments is in line with a similar recovery enjoyed by regional trading partners, with demand for basic chipsets likely tracking the gains for higher value-added electronics.

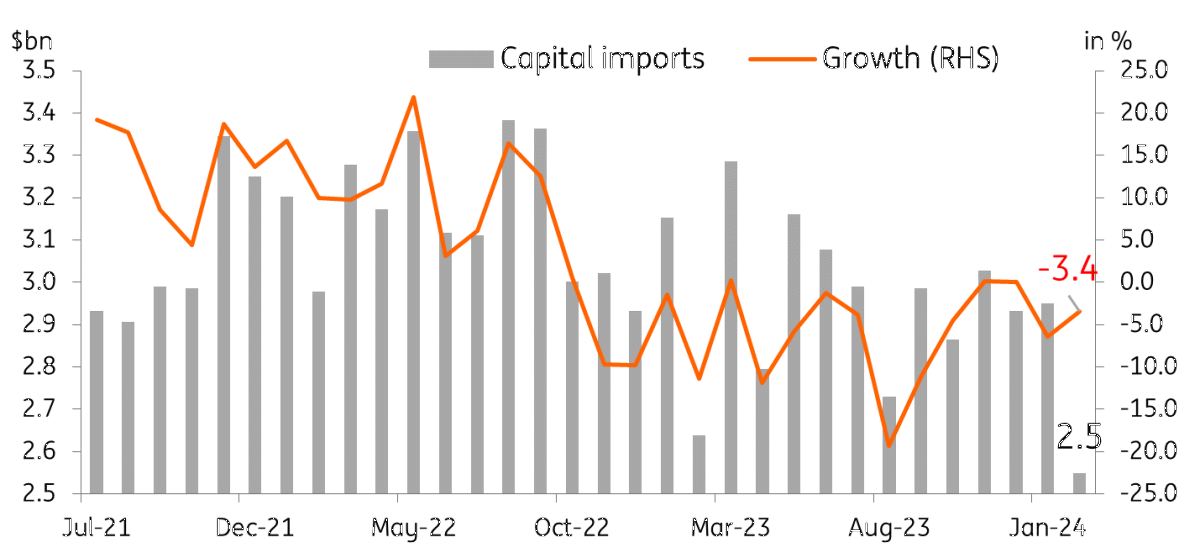

Imports rose a decent 6.3% YoY, reversing the drop of 6.1% YoY in the previous month. Almost all subcategories posted expansion. Raw materials, fuel, and consumer imports all grew, rising 11.8% YoY, 8.3% YoY, and 9.2% YoY, respectively. The lone sector that posted a contraction was imports of capital goods, which dipped by 3.4% YoY.

The decline in inbound shipments for capital goods tracks the subdued pace of expansion for the economy's capital formation, with investment outlays likely constrained by elevated borrowing costs. The muted performance of this key sector is quite telling as it could point to subdued potential output in the months to come as capacity is not improved.

Capital imports remain in contraction

Gain in exports and better trade deficit dynamics a positive

The strong gain for the export sector should help support overall GDP performance for the first quarter of the year. Although heavily dependent on the electronics subsector, the stark pickup in outbound shipments helped move the trade surplus into a less pronounced trade deficit.

Market participants were bracing for a worsening trade deficit, which would fuel pressure on the PHP. The surprise jump in exports would mean less pressure on the currency, which will be key in the near term given the recent pullback by Asian currencies due to evolving expectations for the Fed pivot.

In the coming months, we expect the trade deficit to remain substantial in the coming months as imports rise, which, alongside souring sentiment, could translate to renewed pressure on the PHP with the central bank likely active in smoothing out volatility in the spot market.

Trade deficit improves in February but could stay substantial in the near term

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap