Philippine central bank pressured to cut rates again as growth outlook dims further

The central bank of the Philippines cut its policy rate by 25 bp as economic growth prospects worsen after a spate of typhoons

| 2.0% |

Policy rate |

| Lower than expected | |

BSP forced into action as fiscal stimulus remains largely absent

The Philippine central bank cut its policy rate to 2.0% in a bid to resuscitate falling bank lending and combat the economic recession.

Although real policy rates are now even deeper into negative territory (-0.5%), the central bank pressed on with a fresh round of rate cuts as 4Q GDP is now expected to worsen from the contraction seen in 3Q GDP. Agriculture and real property damage from a string of violent typhoons are expected to shave off 0.15 percentage points off from 2020 growth and may have convinced the Bank to act while fiscal stimulus remains largely modest.

The central bank tweaked their 2020 inflation forecast higher to 2.4% (from 2.3%), probably due to the uptick in food inflation due to agriculture damage and the onset of African swine fever.

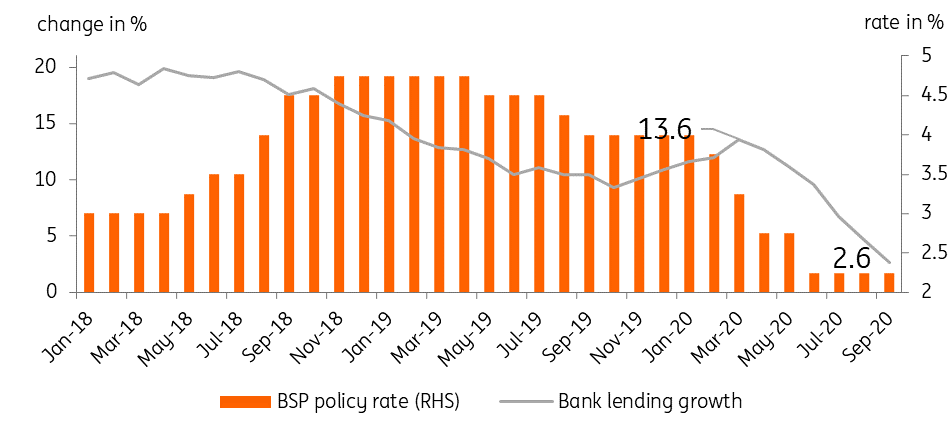

Philippines bank lending and policy rate

Rate cut unlikely to move the bank lending needle

Despite the fresh round of easing, we are not confident that bank lending will pick up anytime soon given the dimming growth outlook with unemployment elevated and consumer sentiment still negative. Meanwhile, the lack of fiscal stimulus may likely delay a sharp rebound in growth, which in turn will keep bank lending and investment appetite muted in the near term.

We believe the central bank will likely pause at its December meeting, now that real policy rates have fallen even deeper into negative territory with the central bank likely calling for a renewed push for additional fiscal spending to address the freefall in economic activity as Covid-19 infections remain elevated in the country.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

19 November 2020

Good MornING Asia - 20 November 2020 This bundle contains 4 Articles