Philippines central bank maintains policy rate amid slowing growth

The Bangko Sentral ng Pilipinas retained its policy stance today, with the bar for additional rate hikes now relatively high following a disappointing second quarter GDP report

| 6.25% |

"Target RRP"new title for the BSP's policy rate |

| As expected | |

BSP retains policy rate at 6.25%

No fireworks were seen from the Bangko Sentral ng Pilipinas (BSP) today with the central bank simply maintaining its current policy stance. The BSP opted for another “hawkish hold” by keeping policy rates at 6.25% while maintaining readiness to hike should data conditions warrant further tightening.

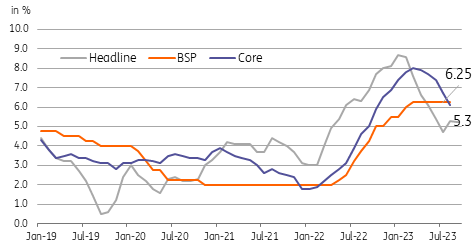

The BSP adjusted its inflation forecasts for 2023 and 2024 given the recent uptick in both food and energy prices. With 2023 winding down, the focus should shift to how the inflation path is evolving for 2024 and 2025. The BSP now projects inflation to settle at 5.8% for 2023 (from 5.6% previously) and 3.5% for 2024 (from 3.3% previously).

BSP Governor Eli Remolona also indicated that barring any additional supply shocks, inflation should settle back within target by the fourth quarter.

BSP hopes inflation surge is short-lived

BSP on hold for as long as the Fed stands pat

The BSP extended its pause for the fourth consecutive meeting, with Governor Remolona navigating the challenging financial and economic landscape. We believe Remolona faced a rather high bar for justifying additional rate hikes at this point after the disappointing second-quarter GDP report. However, the recent spike in food and energy prices – which forced up headline inflation to 5.3% year-on-year last August – likely prompted Remolona to opt for a pause at this juncture to balance out the need to keep policy restrictive while not hurting already fragile growth further.

Governor Remolona will likely walk this tightrope for the rest of the year, balancing flagging growth momentum amidst higher supply-side induced inflation. The only exception to this scenario would be a rate hike by the Federal Reserve, which could prod the BSP to follow with a rate hike to maintain the modest 75bps interest rate differential with the Fed.

What’s in a name? BSP policy rate now called the Target RRP

The BSP has also begun to refer to its policy rate as the “target RRP”, the rate set by the Monetary Board. The market-determined rate that is the result of BSP’s monetary operations would now be referred to as the Overnight RRP.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap