The Philippines’ central bank looks past inflation and keeps rates on hold

The central bank of the Philippines kept rates unchanged even as inflation accelerated, citing the need to support the economic recovery

| 2.0% |

Overnight reverse repurchase ratepolicy rate |

| As expected | |

Philippines central bank looks past “transitory” price spike

Bangko Sentral ng Pilipinas maintained its policy rate at 2.0% despite headline inflation surpassing the target as monetary authorities believe the rise in prices is transitory.

Inflation surged to 4.7% in February, moving well-past the central bank’s 2-4% target range with supply-side shocks forcing food and transport costs higher. The Philippines is dealing with an outbreak of African Swine Fever (ASF) which has forced meat inflation to spike more than 20%, forcing authorities to implement price caps in the capital.

With the economy in recession and increasing numbers of Covid-19 cases resulting in a two-week partial lockdown, governor Benjamin Diokno opted to accommodate the current price spike while indicating that supply-side remedies, such as increased pork importation, would be more effective in stabilizing meat prices.

The governor remains confident that prices pressure will gradually fade with inflation decelerating in the second half of the year, but conceded that the average inflation rate for the year could settle above target at 4.2%.

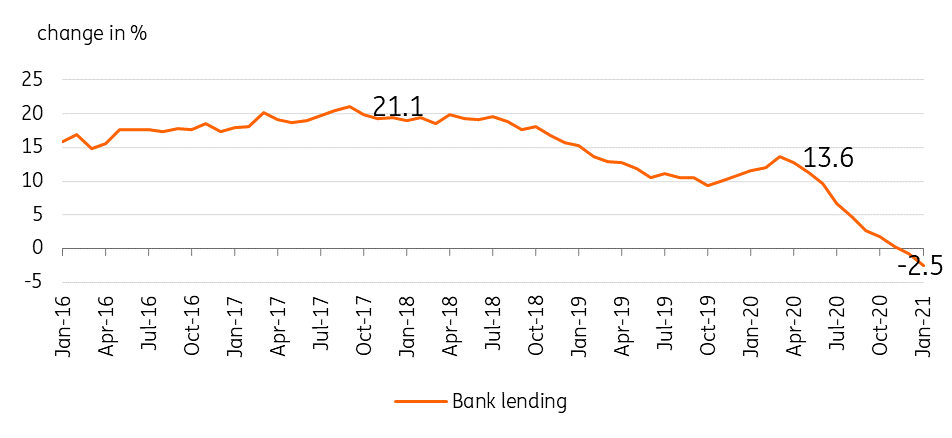

Philippines bank lending growth

Not time to pull the plug just yet

The central bank governor reiterated his support for the fledgeling economic recovery, highlighting that 2021 would be the start of the recovery phase for the economy in recession.

Despite substantial rate cuts and liquidity support, bank lending has crashed into negative territory given weak demand from both corporates and households

He hinted at retaining monetary support as long as the economy required it, suggesting that the previously mentioned “long pause” would in effect be here for a little while longer. He also indicated that monetary authorities were carefully crafting an exit strategy from its current liquidity support program while also qualifying that it was not time to pull the plug on monetary stimulus.

Despite substantial rate cuts and liquidity support, bank lending has crashed into negative territory given weak demand from both corporates and households given the recession, suggesting that last year’s easing efforts have yet to assist.

We expect the central bank to keep policy rates unchanged in the near term, with the Bank willing to look past the supply side-induced price spike for now to maintain support for the economic recovery. The central bank may consider a rate hike if inflation remains stubbornly high, which could dis-anchor inflation expectations and spark second-round effects such as wage and transport fare adjustment.

With the central bank on hold, we expect the currency to remain stable in the near term as corporate dollar demand stays soft given fading economic output.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

25 March 2021

Good MornING Asia - 26 March 2021 This bundle contains 3 Articles