Philippines: BSP keeps rate steady but improving outlook opens door for future adjustments

Fading inflation eases pressure for BSP to hike rates for now but improving outlook opens door for future adjustment

| 2.0% |

BSP policy rate |

| As expected | |

BSP holds rates steady while at Boracay

Bangko Sentral ng Pilipinas (BSP) kept policy settings untouched again today with Governor Diokno citing the need to retain support for the economic recovery. Speaking to reporters at Boracay, Diokno did note that economic growth “was gaining solid traction” but may have opted to await additional data points before considering adjusting his stance.

BSP held its monetary policy meeting at one of the Philippines’ beach resorts, perhaps to signal that some form of normalcy was returning and that economic growth was on the right track.

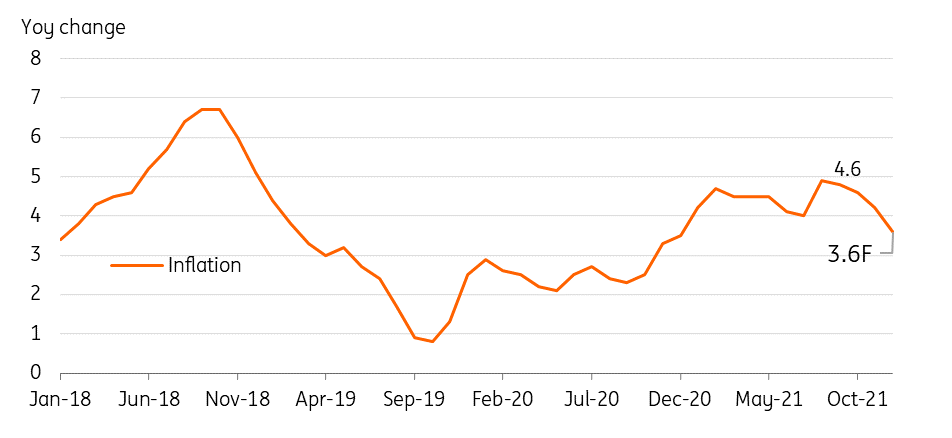

Philippine inflation decelerates to close out 2021

Inflation to decelerate while growth picks up

Recent inflation trends suggest that the elevated price pressures have faded somewhat as supply-side measures to address food shortages, take hold. Inflation is expected to decelerate to close out the year and the BSP lowered its inflation forecast to 4.3% (from 4.4% previously) for 2021, retained its 2022 forecast at 3.3% but nudged its outlook for 2023 inflation to 3.3 (from 3.2%).

Slightly slower inflation gives the central bank some breathing room to retain accommodation for now, however, a surprise pickup in economic growth opens the door for possible adjustments down the road. We expect BSP to retain its accommodative stance to close out the year but we’ve pencilled in a possible rate hike by the central bank by 2Q 2022. By then the Philippine economy would have logged 4 straight quarters of GDP growth, which may be enough to convince Governor Diokno to finally reverse his current accommodative stance.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap