Philippines: BSP hikes rates by 50bp to keep up inflation fight

Bangko Sentral ng Pilipinas (BSP) has increased its policy rate by 50bp, a move widely expected by the market

| 5.5% |

BSP policy rate |

| As expected | |

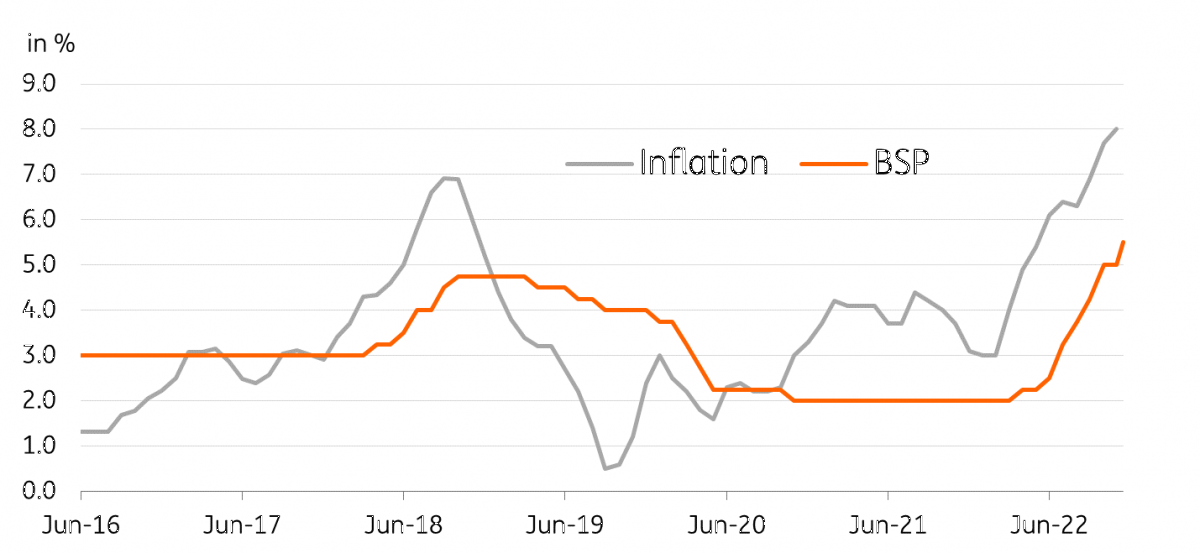

BSP has increased its policy rate by another 50bp, taking the overnight reverse repurchase agreement rate to 5.5%. Governor Felipe Medalla had previously indicated he would prefer to maintain a 100bp differential over the US Federal Reserve funds rate, so simply matched the Fed’s increase overnight. Less pronounced pressure on the peso of late allowed the BSP some space to downshift the pace of rate hikes from 75bp to 50bp today. However, given elevated core and headline inflation, not to mention BSP’s own admission that inflation risks are tilted to the upside, a sizable rate increase was warranted.

BSP downshifts to 50bp hikes but more tightening in the pipeline

Rate hikes to continue into 2023

BSP adjusted its inflation forecast for 2023 given additional data points and developments while keeping its forecast for 2022. BSP expects inflation to settle at 5.8% this year while 2023 inflation is now forecast to average 4.5% (from 4.3%). Meanwhile, we expect inflation to stay elevated well into 2023 given the prevalence of second-order effects, or price increases driven by the initial energy price shock. With inflation expected to stay high, we believe BSP will retain its hawkish stance going into 2023, taking its cue mainly from the Fed while also monitoring the path of inflation.

Thus we expect the BSP to bring its policy rate to as high as 6.0-6.25% next year, although recent comments from Medalla suggest that he is open to a potential “BSP pivot” sometime in the second half of 2023. The peso should likely move sideways with today’s rate hike largely priced-in by market participants.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap