Philippines: Base year shift results in slower inflation for January

The Philippines adopted 2018 prices as the new base year for inflation, resulting in slower inflation

| 3.0% |

January CPI inflationBase year 2018 |

| Higher than expected | |

January inflation settles at 3%

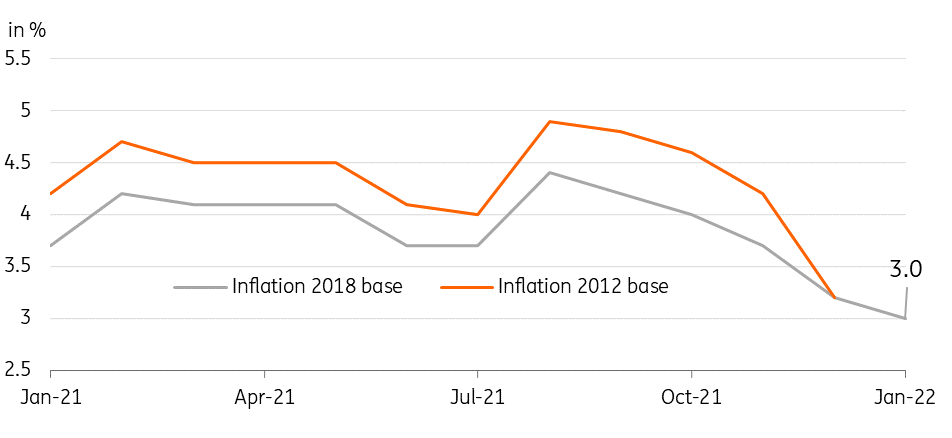

The Philippine Statistics Authority (PSA) adopted 2018 prices as the base year for computing inflation beginning 2022. Adjusting both the components and weights of the CPI basket and adopting 2018 prices as the base year resulted in January inflation settling at 3%. This was down from 3.2% in December but slightly higher than the market consensus of 2.8%.

Downward pressure was provided by the sharp slowdown in food inflation (1.6%) and cheaper utility costs while upside pressure came from more expensive transport costs. More interestingly, the PSA announced that 2021 full-year inflation was actually 3.9% based on 2018 prices, much lower than the previously reported 2021 full-year inflation rate of 4.5%. This suggests that inflation did not breach the central bank's 2-4% target in 2021.

No breach after all? Base year shift results in slower inflation

BSP doubles down on dovish rhetoric

The January inflation reading and more importantly the revision to 2021 inflation appears to have given Bangko Sentral ng Pilipinas (BSP) a little more space to retain its accommodative stance. After the inflation report, Governor Diokno indicated that BSP “need not move in lockstep with the Fed” suggesting that he prefers to maintain his stance despite impending rate hikes by the Fed.

The base-year shift will have a material impact on 2022 inflation but we believe price pressures could intensify in the coming months. Supply side bottlenecks remain unresolved as domestic hog production continues to be hampered by the spread of African Swine Fever (ASF) while crude oil prices edge higher. Meanwhile, improving economic conditions have fueled the modest rebound of demand-side pressures, which could nudge inflation higher as well. Persistent inflation pressure coupled with the likely reversal in financial flows linked to Fed hikes could eventually convince a rather dovish Diokno to finally consider a policy adjustment by the end of 2Q.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap