November US activity data add to market doubts on Fed policy

Poor November data on retail and industrial activity reinforce the message that recessionary forces are building. So while the Federal Reserve’s near-term focus is defeating inflation via higher interest rates, expectations of a policy reversal later in 2023 will only grow

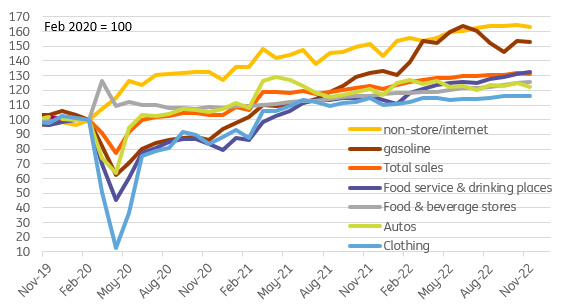

Retail sales show broad falls

US November retail sales were softer than hoped, falling 0.6% month-on-month versus the -0.2% consensus expectation. This is the biggest decline in 11 months. We knew that autos (-2.3%MoM) were going to be a drag given lower unit sales released at the start of the month, while the fall in gasoline prices was also going to depress sales given it is a dollar value figure – although we thought it was going to be even worse than the -0.1% it recorded.

Unfortunately, there was a broader weakness with the "control group" which excludes volatile items such as autos, gasoline, food service and building materials, sinking 0.2% MoM after a solid run of 0.4% and 0.5% MoM gains. Furniture fell 2.5%, department stores saw sales fall 2.9%, while electronics were down 1.5%. On the positive side of the ledger, food and beverage sales rose 0.8% while health/personal care increased 0.7% and miscellaneous sales rose 0.5%.

Level of US retail sales versus February 2020

Retail sales can be quite a volatile report, but this is a disappointing outcome, especially with some downward revisions also thrown in for good measure. In an environment where the Fed is purely focused on the battle to get inflation down and is signalling another 75bp of hikes from here on, it is going to reinforce market concerns about the prospect of a recession.

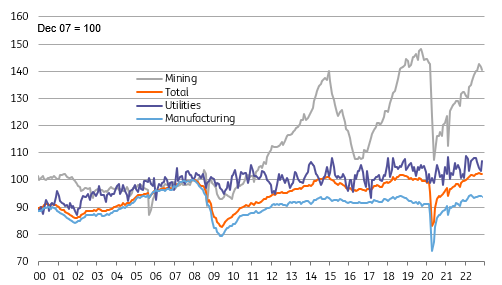

Shrinking manufacturing output intensifies recessionary fears

Adding to the negativity surrounding the US economy, the Fed has reported that industrial production fell 0.2% in November versus the consensus expectation of 0.0%. This weakness was led by a 0.6% drop in manufacturing output – the first decline since June. Admittedly there was a small upward revision to October's print, but the overall outcome is still weaker than hoped.

Auto output fell 2.8%, but even excluding this major component, manufacturing fell 0.4%. Utilities rose 3.6% on colder weather while mining fell 0.7%, presumably in response to falling oil prices.

US industrial production levels

This report adds to concerns that with the Fed not yet done with rate hikes, a recession has to be the base case. This will help to dampen price pressures as companies fight for customers, and with the inflation basket strongly orientated towards housing and vehicles, we think inflation will fall to 2% late next year. As such we stick with our call that there will be an eventual policy reversal from the Fed with interest rate cuts in the second half of 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap