Norges Bank cuts rates, signals more could come

The sharp fall in oil prices and global interest rate expectations meant Norges bank easing was only a matter of time. Today's 50bp move could be followed by more, but for the time being the sharp fall in NOK over recent days will do some of the central bank's work for it

Rate cuts were increasingly a question of ‘when’ not ‘if

In a surprise move, the Norges Bank has become the latest central bank to cut interest rates by 50 basis point, announcing the move a week before its next scheduled meeting.

Policy easing was looking increasingly likely though, and it was really just a question of when and by how much. Don’t forget that the Bank tends to set its policy rate fairly mechanically, so the fall in oil prices and sharp flattening in global interest rate expectations will have both translated into sharp downward influences on its forecasts.

However, the press release also notes the risks to unemployment, referencing some of the lay-off notices we’ve heard publicly about over recent days.

The Norges Bank has room to do more

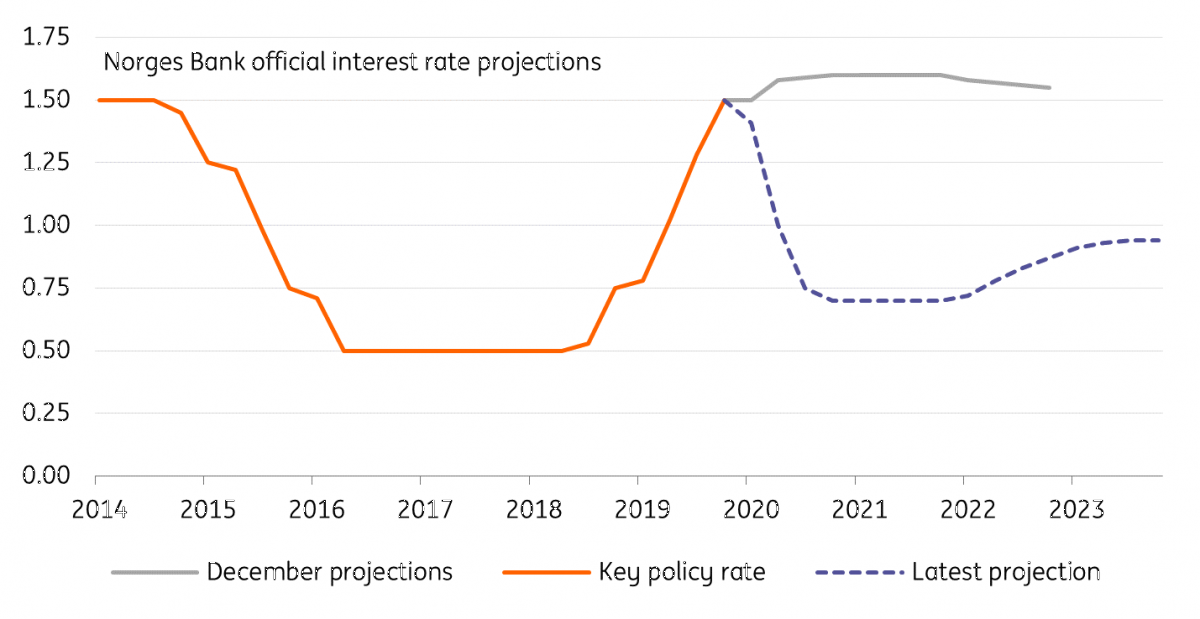

With the key deposit rate at 1%, the central bank has more easing room than some of its nearest neighbours. Policymakers have explicitly said that rates could be lowered further, and we certainly wouldn’t rule that out, particularly in light of the drastic interest rate moves markets are increasingly looking for from the Federal Reserve. The latest policy rate projection from the central bank is pencilling in a little over one additional rate cut later this year.

There are however a couple of mitigating factors that the Norges Bank will be bearing in mind.

Firstly the currency has weakened considerably - as of yesterday, the trade-weighted NOK was over 6% weaker than the central bank had forecasted for the first quarter (average) back in December. That means the currency is doing at least some of the central bank's work for it.

Secondly, the sharp fall in oil prices is mitigated to some extent by the level of breakeven production costs in the Norwegian oil industry. The central bank has said in the past that it believes this to be around USD10-35 per barrel following cost-cutting measure over recent years.

Those factors probably mean we won’t see any further easing at next week’s formal meeting, and that seems to be what is implied in the central bank's latest interest rate projections. However only time will tell how the virus will fully impact the economy, so we shouldn’t completely rule out more easing from the Norges Bank over the next couple of months.

Ultimately though, as policymakers have themselves noted, there’s only so much monetary policy can do to mitigate the economic impact of Covid-19.

The Norges Bank's new interest rate projection

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap