Nickel: Something’s got to give

Nickel prices are up 27% since December yet stainless steel prices have hardly moved. Until stainless can prove to pass these higher costs on, nickel looks vulnerable

Stainless feeling the squeeze

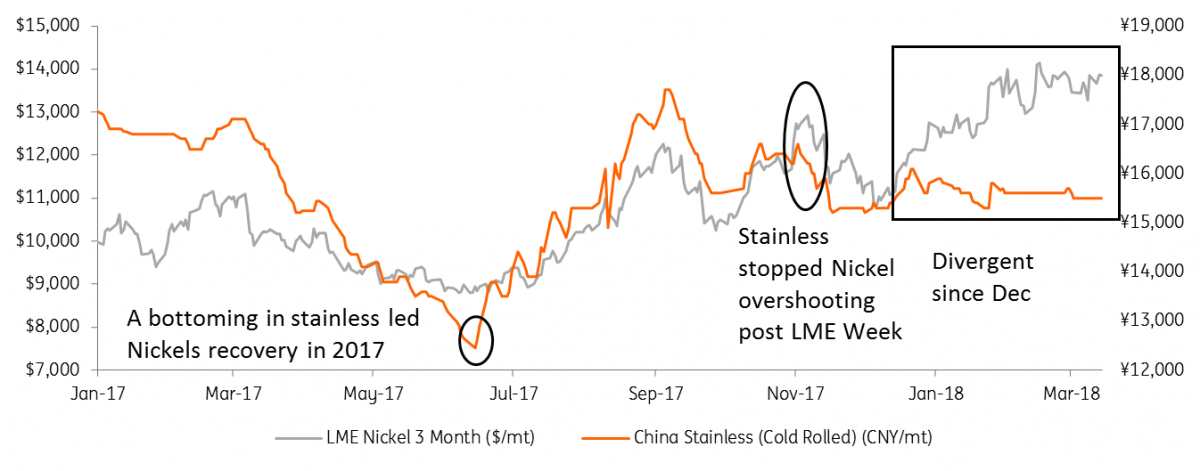

A recovery in stainless steel led the nickel recovery through the second-half of 2017. Even when EV exuberance saw prices overrun post LME week, it was stainless that set the path for correction.

Stainless steel is responsible for c.70% of nickel demand compared to only c.5% from the hyped up battery demand. But since nickel rallied in December, Chinese stainless prices have been flat. Even before operating costs, Chinese stainless steel prices are trading below the nickel/steel/chrome inputs. Shanghai metal markets (SMM) has reported producers in the south are now cutting production, and we've already heard about production switching to carbon steels for better margins, both hurting demand.

The last time such a squeeze occurred was the post-Indonesian Ore ban rally in 2014, and as we know higher prices were not sustained. The current state of affairs looks vulnerable should the speculative flows turn.

Stainless not reflecting the nickel rally

Stainless steel margins most squeezed since 2014 (CNY/mt)

Implied margin pre-operating costs: Wuxi 304 Stainless - (8%Ni, 18%Chromium, CRC)

Flows and fundamentals

According to the International Stainless Steel Federation, stainless output grew 5% last year following a stellar 10% in 2016. This was a year of two halves however as a build-up in stainless stocks saw Chinese output hit the brakes in the middle of the year which in turn drove a stainless and nickel price recovery. High stainless steel stocks seem to be once again pressuring producer margins this year.

Nonetheless, Nickel demand has been strong to date as reflected by surging physical premiums and the draws in LME stocks. Stainless friendly cathodes are down the most, by 163kt since the start of 2017 but it may have been exaggerated ahead of a major brand de-listing on the LME (Combine Norilsk H-1). Now an additional 50kt of cancellations in briquettes has given the EV fever a shot in the arm.

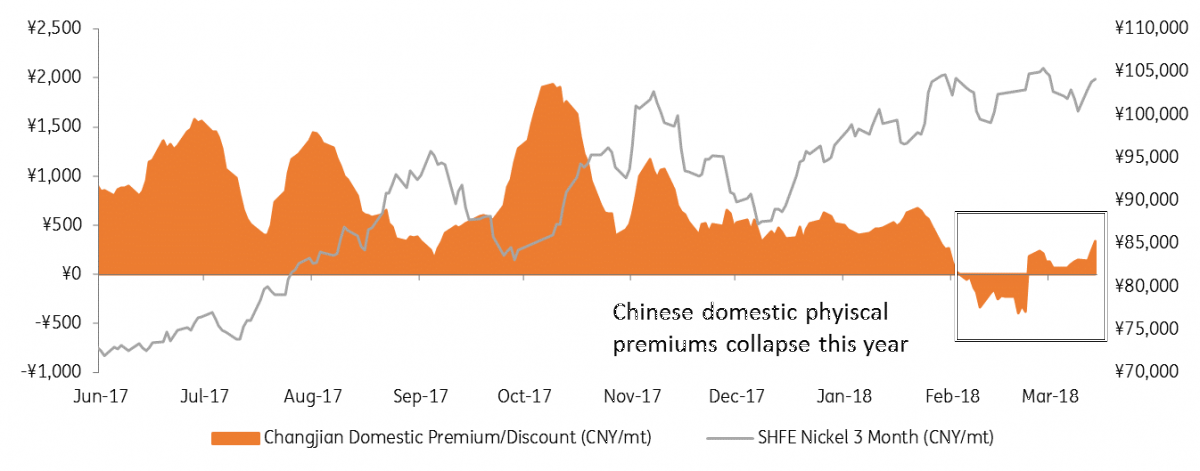

While respecting the tightness, ING expects a 150kt nickel deficit this year, Shanghai Futures Exchange (SHFE) activity points to excessive speculation running ahead of the fundamentals. We pointed out massive open interest flows earlier in our article: Beware the Chinese speculator.

But volumes are still very high which we expect to have a largely retail base. Most tellingly, the premium for physical prices over paper have collapsed in China ever since the SHFE prices rallied and diverged from stainless.

SHFE rally sees domestic premiums collapse (CNY/mt)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap