Nickel: A messy divorce or amicable split for demand?

Nickel has surged 17% in 2018 with the market gripped by 'electric vehicle fever' and buoyed by an exaggerated draw on exchange stocks. We've been concerned for a while about the squeeze on Chinese stainless steel, which has lasted longer than we thought. The market expects a longer-term divorce of class 1 from class 2 grades. It's going to be a rocky ride

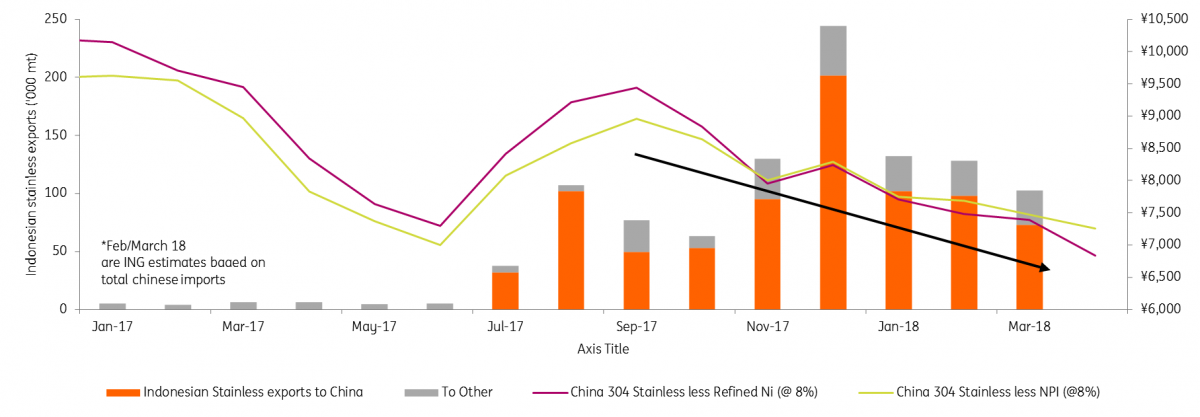

Indonesian stainless steel exports squeeze Chinese margins

The stainless squeeze is relieved by NPI discounts

In our last nickel note, we argued something has to give. Higher prices are squeezing Chinese stainless steel margins so either stainless must rise or nickel must fall. Two months on, however, and neither has happened. The technical charts even suggest nickel could go higher and many in the investment crowd are calling for $18k+ to start incentivising class 1 (refined 99.98% nickel grade) projects to supply future electric vehicle (EV) demand. The trend has not been our friend, and as the precariously-high speculative volumes on SHFE have stabilised, we have softened our earlier call for such a sharp sell-off.

Lower stainless margins not yet impacted nickel prices as quickly as we expected but we still think the market faces headwinds.

The Chinese stainless producers have, in effect, lost pricing power and are unable to pass higher nickel unit costs on. The ramp-up of the 2Mtpa, soon to become 3Mtpa, Tinghsan stainless steel in Indonesia is flooding the Chinese market with cheaper-priced stainless steel so that onshore stocks are building and margins are strained to compete. The massive Tinghsan Indonesian mill produces its own nickel pig iron (“NPI” <20% nickel grade still bonded with iron i.e ''FeNi") and is estimated to have a $500/mt cost saving vs its competition. The exports to China are indeed causing tensions and it's been reported that local industry has even lobbied for anti-dumping measures and the Ministry of Commerce has appealed to diversify exports. A drop in exports to China since has eased the pressure a bit but onshore margins remain far from healthy.

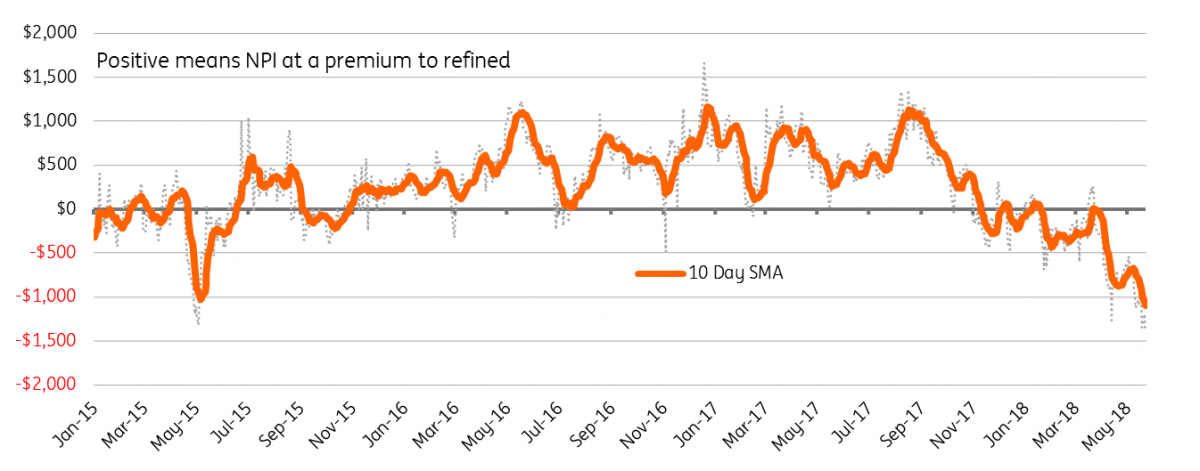

What has surprised us, is the sheer discount for NPI that has emerged compared to class 1 products. This has provided significant relief to those stainless producers buying NPI. The stainless steel industry, unlike the emerging electric vehicle (EV) battery/nickel sulphate demand, can readily use both class 1 and 2 nickel and historically paid a premium for NPI because of the beneficial iron units for steel-making. That premium was swiftly eroded in late 2017 as the EV hype for nickel demand took off. Then, from being almost equal in April 2018, NPI prices have significantly underperformed refined nickel to the tune of $1,000/mt. With more supply coming from NPI/FeNi vs refined this year (+190kt vs -50kt) the discount might well widen a bit further but we think it's approaching a limit where any further widening would start to bring about substitution. It’s simply too soon in the EV story (less than 5% of demand) for refined nickel prices to tear off independently.

Nickel Pig Iron has gone from premium to discount ($/mt)

Chinese price differential at 100% Ni-Equivalent (Ex-VAT)

Too soon to split nickel in two

NPI intrinsically correlates with the LME price because of the contained nickel units that are amenable to the major stainless steel demand base (c.70% of primary nickel demand, 80% if including scrap). This overlap in demand will remain sizeable and keep the market pegged together for some time yet and indeed pegged to the purchasing power of the Chinese stainless steel mills.

China apparently consumed 630kt of NPI/FeNi last year, which still left the Chinese stainless industry using 300kt of class 1 units. Globally, the stainless industry uses over 500kt of primary units (over 20% of demand) but we focus on the Chinese mills since the ex-China stainless prices are holding up better.

Those stainless producers, China or otherwise, that do get squeezed out from buying higher priced nickel units or tempted towards cheaper NPI, will free up class 1 units, which in turn weighs on the refined premiums and LME prices. The demand set to be displaced is many multiples of the current EV demand (7x) which is why we think the road towards class 1 incentive pricing will be a very rocky ride up.

Whilst the squeeze is milder, NPI prices have also been dragged up 8% year-to-date in the wake of the LME and are also approaching unaffordable levels. Chinese stainless steel producers using NPI are, in turn, still considering extended maintenance, switching to carbon steels, or cutting production altogether as they struggle to break-even at current prices. Bulls who see nickel going higher must suppose the current 10% NPI discount can go even wider if these mills are to keep producing. At these discounts, this again should spur more replacement of refined by NPI and ultimately weigh on refined prices. Whereas before we expected that a buyers strike from the mills could hit demand sharp enough to resonate across both class 1 and 2 markets, we now anticipate a more gradual price-induced NPI substitution, which will release class 1 units to cap the rallies.

Refined nickel use in stainless keeps NPI and refined linked

Stainless integration equals nickel insulation

It also fair to say that in our earlier note we also underappreciated just how insulated much of the Chinese stainless steel industry is to nickel prices. Norilsk Nickel estimates that 484kt of nickel in NPI is integrated with stainless steel so that only 33% of the NPI market is actually bought and sold at market rates. The nickel in stainless demand at risk is therefore perhaps under half the 40% coming from total Chinese stainless nickel demand. Nonetheless, it’s still a sizeable portion. Norilsk Nickel's own analysis is that 25% of stainless production globally is not currently cost-efficient.

At some point, a commodity price must be set by what consumers are willing to pay. EV demand is still a small portion but for (the unintegrated) Chinese stainless steel industry, nickel and NPI are becoming unaffordable.

At some point, a commodity price must be set by what consumers are willing to pay. As we see it, it's the unintegrated stainless mills that set the achievable market rates for NPI or refined but both are becoming unaffordable to them. The tonnages here still far outweigh EV usage so nickel’s continued independence from the purchasing power of the mills looks unlikely unless NPI were to get ever further discounted. As above, we think that divergence has limits before a displacement of demand begins freeing up sizeable refined units. The market might well have class 1 incentive prices in view but as the Chinese stainless demand base gets squeezed in the middle, the path up promises to be a rocky ride and consumers would do well to seize the dips that we expect to occur.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap