Netherlands: Going for another gold after strong 2017

While not yet Olympic, the Dutch economy clearly qualified for a medal in the game of generating the highest growth rate in 2017

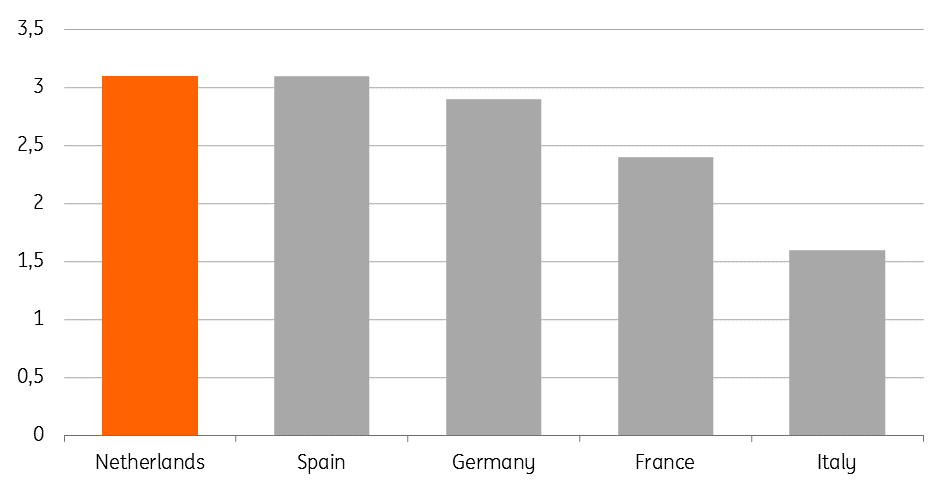

The strongest annual growth in a decade allowed the Dutch economy to beat its peers with a clear lead. Dutch GDP expanded by 3.1% in 2017 as a result of yet another strong quarter. Together with Spain, the Netherlands beat all large Eurozone economies, with 3.1% in Q4 2017 compared to Q4 2016.

| 3.1% |

Netherlands GDP growth rate2017 (YoY) |

Netherlands beats the other large Eurozone economies

GDP-volume growth in Q4 2017 compared to Q4 2016 (%)

With the Netherlands high up in the Olympic medal ranking- mainly because of a great team of ice skaters- parallels come easy. But while an Olympic medal usually comes at the expense of someone losing, that's not the case economically, with the Dutch winning on the back of similarly decent growth in the rest of the Eurozone, leading to 5.5% export growth. Domestic demand was the real winner, with household consumption growth accelerating to 1.8%. The revival of house sales, continuing increases in employment, low inflation, high consumer confidence as well as expectations of further real income rises contributed to consumption growing at the fastest rate since 2008.

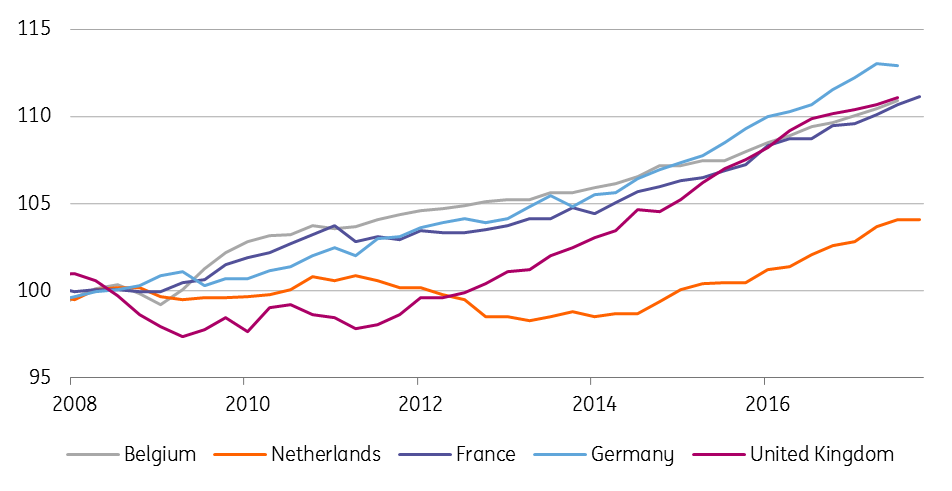

For a long time, consumers were in the doldrums. Only since the end of 2014 are Dutch consumers again willing to spend more, while in neighbouring countries, the recovery had already been well underway. It took until 2017 for consumption to really pick up, but the Netherlands is still nowhere near leading the pack in terms of consumption development since the start of the 2008 crisis. We note that actual individual consumption, which includes both household consumption and publicly financed (often health care) consumption directly benefitting households, is up 4% in the Netherlands compared to 2008, while peers such as Belgium, France and Germany have seen increases larger than 10%.

Development of Dutch consumption still lagging behind

Actual individual consumption, seasonally-adjusted volume-index 2008=100

Our research shows that consumers have a hard time believing that the pick-up is sustainable (half of them see the economic recovery as a bubble). But we note that in contrast to the pre-crisis era, growth is currently not accompanied by high growth in household debt. Consumers do not seem to be skating on thin ice at the moment. On the contrary: support from the labour market is building up. Employment growth continued in the fourth quarter, with 39,000 more people having a job. Most strikingly, the substantial increase in the number of fixed contracts that was launched in the third quarter of 2017 continued in the fourth quarter. Increasingly, businesses report a lack of sufficient labour as the main factor limiting production.

| 0.8% |

Netherlands GDP growth rateFourth Quarter 2017 (QoQ) |

The 0.8% QoQ GDP growth rate in the fourth quarter implied a festive end to the year. In contrast to preceding quarters, fourth quarter growth was primarily based on growth in exports. Sector-wise, the main engines of growth in the fourth quarter were commercial services and manufacturing. The automotive and machinery industry performed especially well.

With the output gap now closed, the Netherlands is heading towards another year of strong growth. The Dutch economy is getting off the starting block like ice skater Ireen Wüst heading for her tenth Olympic medal.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap