More evidence for a 2Q US growth rebound

After the surprise contraction in the first quarter, there is growing evidence to suggest the economy will rebound strongly in the second with 4%+ GDP growth on the cards. The labour market is strong, consumers are spending and there is now evidence that manufacturing isn't struggling as much as feared while construction output continues grinding higher

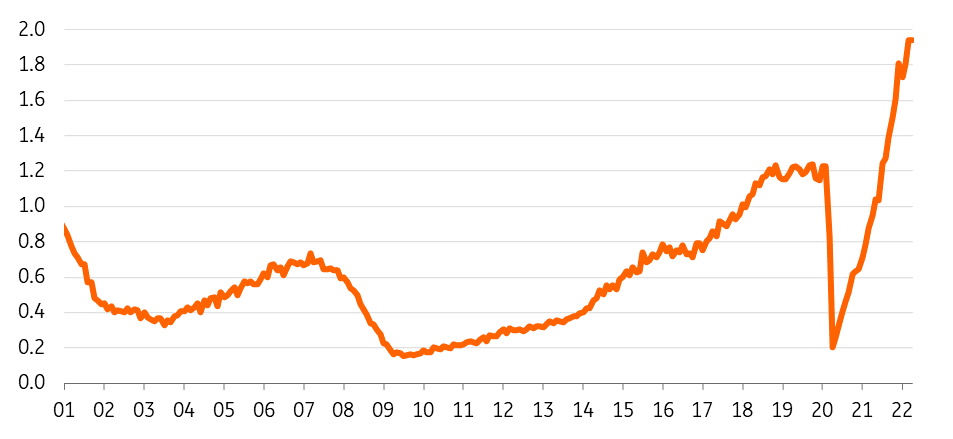

Job openings remain huge as worker shortages persist

The Job Opening and Labour Turnover statistics (JOLTs) reinforce the message that any weakness in Friday’s employment report is down to a lack of workers willing and able to do the job rather than any softening demand. Job openings fell to 11.4mn from an upwardly revised 11.855mn (consensus 11.35mn), but this means there are still nearly two job vacancies for every unemployed American. To put this in context, in the UK there is one vacancy for every unemployed Briton and in Germany, there are just 0.4 vacancies for every unemployed German.

Number of US job openings for every unemployed American

A tighter jobs market means more upward pressure on wages, which is likely to keep inflation stickier in the US than in other developed markets. In turn, this supports our view that the Federal Reserve will continue to be more aggressive in raising interest rates than the European central banks, which will help keep the dollar supported over the next few months.

The quit rate - the proportion of workers quitting jobs to move elsewhere - remained at 2.9% for the third consecutive month with the leisure and hospitality industry feeling the greatest stress, with 5.2% of workers quitting in April.

US manufacturing resilience in the face of Chinese pressures

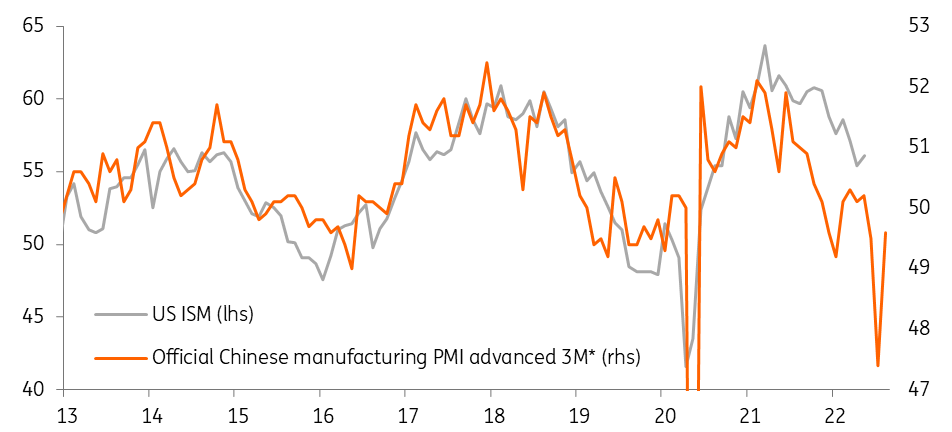

The news from the manufacturing sector was even more upbeat, with the ISM report showing the headline index surprisingly rising to 56.1 from 55.4 (consensus 54.5). We had thought the weak Chinese numbers and mixed regional indices had pointed to the prospect of a dip, but instead, new orders rose nicely to 55.1 from 53.5 and production was up at 54.2 from 53.6. Order backlogs remain intense and supplier delivery times are lengthening again with customer inventories falling sharply.

The ISM tends to follow the China PMI lead, being the world’s largest manufacturing nation, as the chart below shows. China’s aggressive Covid containment strategy, which has impacted factory output hard vis-à-vis the US position, means that there is likely to be less downside in the ISM. Moreover, with China now showing signs of partially relaxing its latest lockdowns there is hope that the China numbers can show some modest improvement and relieve some of the supply chain stresses for US manufacturers.

US ISM versus the Chinese manufacturing PMI

* Chinese PMI temporarily plunged to 35.7 in February 2020 in reaction to the pandemic

The dip into contraction territory for the ISM employment index is not great news, but given the JOLTS data, we attribute this to a lack of workers to fill the roles required. In any case, it is also important to remember that the broader industrial sector is starting to benefit from an uptick in US oil and gas drilling, with the rig count having risen from 586 at the start of the year to 727 currently (a new update will be published later today).

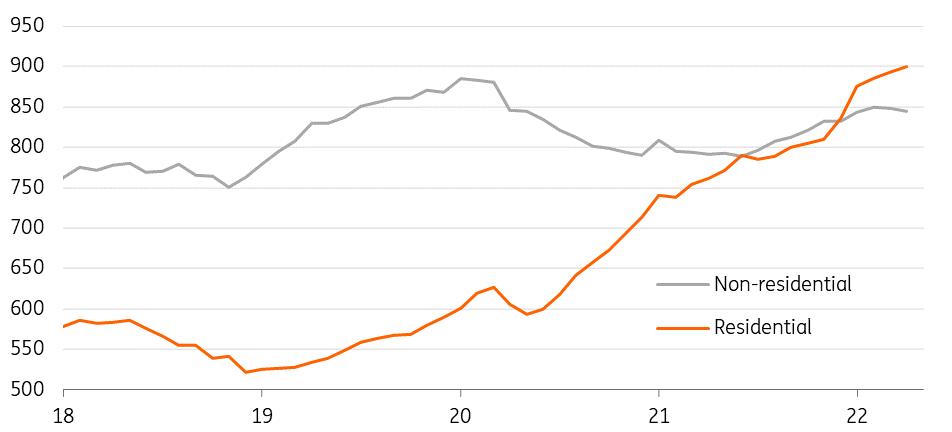

Construction grinds higher, boosting chances of 4% GDP growth

Rounding out the US numbers, construction spending rose a little less than expected (0.2% versus 0.5% consensus), but there were upward revisions of two-tenths of a percentage point to March’s number. Residential was up 0.9%, while non-residential fell 0.4%.

Construction spending ($bn)

In general, the numbers are all encouraging and following on from last week's great consumption data and healthy people movement numbers, we are happy to stick with our provisional 2Q US GDP forecast of 4-4.5% annualised growth.

Looking ahead for the construction sector specifically, we are a little nervous as we move into the second half of the year given the steep drop-off in mortgage demand and the downturn in housing transactions, most clearly evident in new home sales. With housing inventory for sale starting to rise, we suspect that house price appreciation will soon start to top out and possibly fall a little later this year. Home builder sentiment is already softening as new buyer enquiries dip, and in an environment where costs are ratcheting rapidly higher, profitability is going to be increasingly squeezed, which suggests a moderation in growth later in the year. However, non-residential still has scope to grow and if the latest stories suggesting that the Build Back Better programme can still be revived prove to be true in some form, this can help to offset any softening in home building.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap