Monitoring Romania

With the rapid economic recovery phase now behind us and the peak of the fourth Covid wave just ahead, the Romanian economy is starting to feel the need for additional growth drivers. A better than expected agricultural year and sustained investment spending could offset a flattening of the consumer sector

We provide below an overview of the Romanian economy and its prospects as we move ahead into year-end (see below a summary of our main forecasts). We have updated our EUR/RON year-end forecast from 4.92 to 4.95 and we underline that there are upside risks to our inflation forecast as well.

- GDP growth: +7.5% in 2021, +5.0% in 2022

- Inflation (year-end): 5.5% in 2021 and 3.3% in 2022

- EUR/RON (year-end): 4.95 in 2021 and 2022

- Budget deficit: 6.5% in 2021 and 5.3% in 2022

- 10Y local bond yield: 3.8% in 2021 and 3.9% in 2022

GDP growth: Robust but slowing down

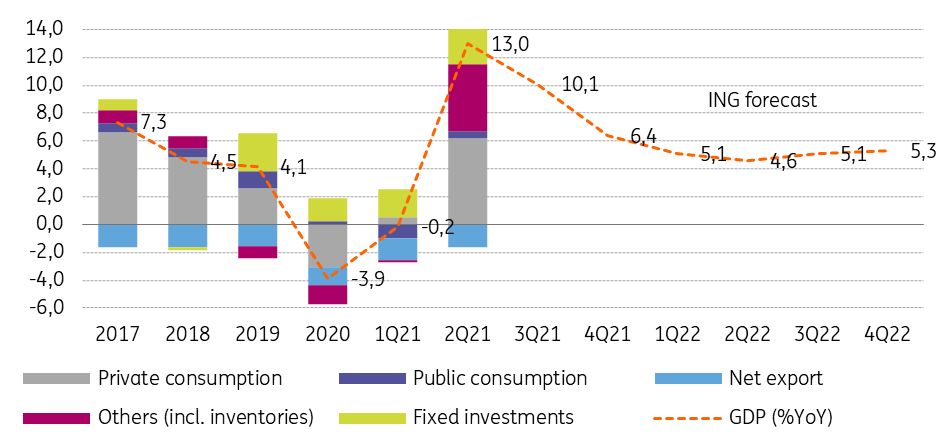

The economy continues to outperform most expectations, growing by 6.6% in 1H21 and already being above its pre-pandemic level. Besides the usual driver – private consumption, which advanced by some 6.0% in the first half of 2021, another significant growth driver has been fixed investment activity which has maintained its double digit growth rate (+12% in 1H21) largely on the back of public investment. We believe that investment will remain a key growth driver in the years to come and that Romania will be one of the main beneficiaries of EU funds via the Next Generation EU programme and the classic Multiannual Financial Framework – a combined total of aprox. EUR78bn. To the extent the utilisation rate is satisfactory, the economy could be running slightly above its potential in the next couple of years. We estimate the annual growth rate to be around 4.5-5.0%.

GDP growth (YoY%) and main components(ppt)

The main risks to the above scenario stem from the Covid-19 situation. Only around 30% of Romania's population has been vaccinated, the second lowest rate in the EU. This leaves it exposed to a new wave of infections. The authorities estimate that the fourth wave will peak in mid-October. Policymakers have already signalled that closing the economy even partially is not an option and only targeted lockdowns will be employed.

We see balanced risks to our 7.5% GDP growth forecast in 2021. For 2021, we are mildly downbeat on our 5.0% growth projection due to a number of factors such as the need to further reduce the budget deficit, flattening external demand and increased interest rates both in the local and external markets. To counter these are the NGEU allocations and by extension, public investment which is envisaged to stay around 5.0% of GDP over the next couple of years.

Industry

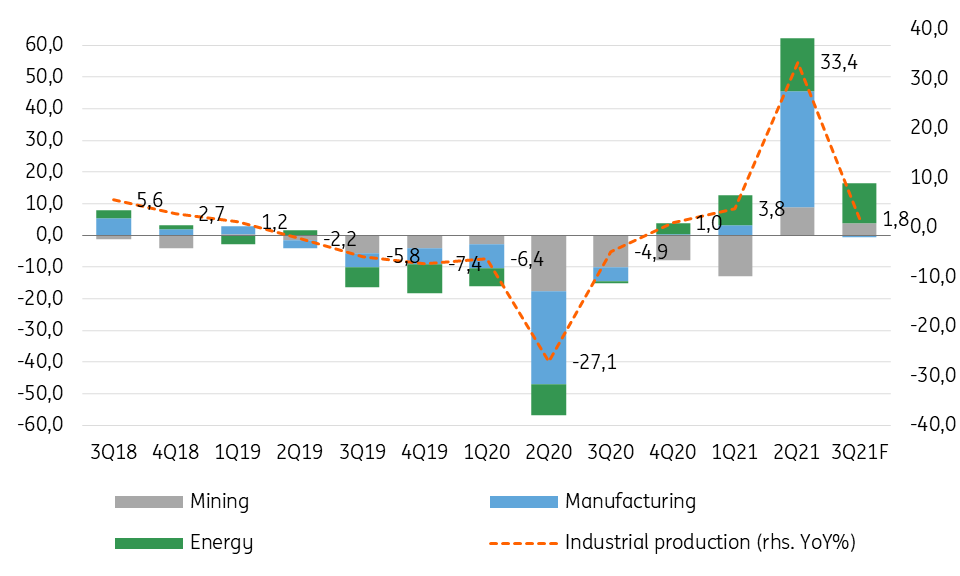

January-July industrial production expanded by 15% compared to the same period of 2020, but it is still almost 3.0% below Jan-July 2019 – a more suitable comparison period given the lockdowns in place back in 2020. Hence, the industrial sector hasn’t yet returned to pre-pandemic levels, and given the ongoing supply chain constraints, a fourth wave of infections and the anticipated slower economic growth, the prospects of reaching pre-pandemic levels this year seem distant. In the manufacturing sector -which has an 80% share of total industrial production- the recovery looks even slower as the most important subgroups have all registered contractions over the first seven months of 2021, compared to the same period of 2019: vehicle production -8.0%, food industry -0.7%, metal construction -1.0% (all seasonally adjusted data).

Industrial production and its main groups (YoY%)

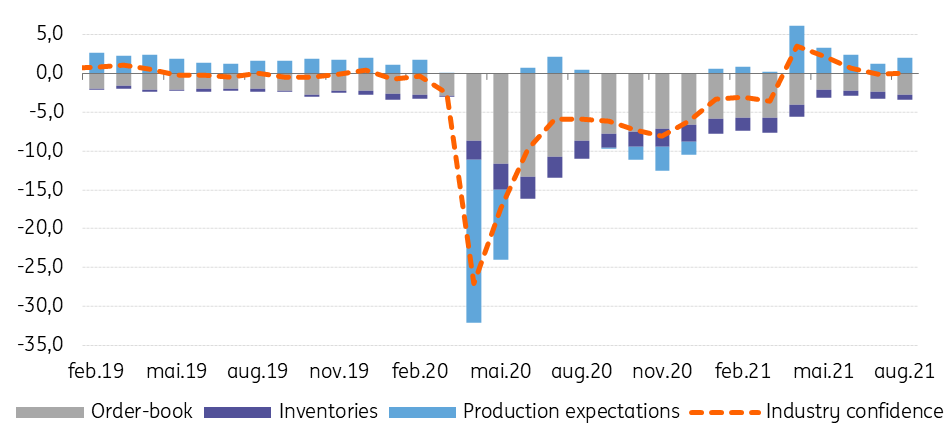

The latest confidence data is also pointing towards a flatter outlook for the industrial sector on the back of a marginal decrease in order books, increased inventories, and stable employment expectations.

Economic Sentiment Index - Industry

Retail sales

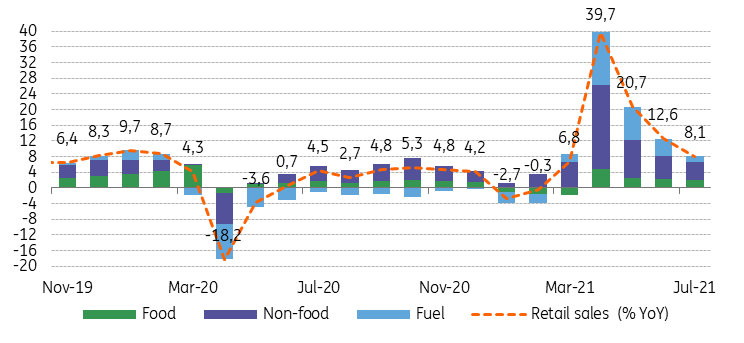

Although in an obvious -and explainable- slowdown mode, retail sales -and by extension the consumer sector- remain one of the most resilient sectors of the economy, roughly half of the 1H21 GDP growth being driven by private consumption. After seven months of 2021, all subcomponents of retail sales witnessed robust advances, with non-food sales expanding by 18.6% versus the first seven months of 2020, followed by fuel (+11.6%) and the less cycle-sensitive food items (+3.5%).

Retail sales (YoY%) and main components (ppt)

Looking forward, the outlook for Romanian retail sales remains positive, but the momentum is fading as the average wage advance is converging towards the inflation rate while the fourth wave of coronavirus infections will likely depress consumer sentiment. On the brighter side, the labour market continues to tighten and this should keep the pressure on wages and consequently act as a backstop to consumer spending.

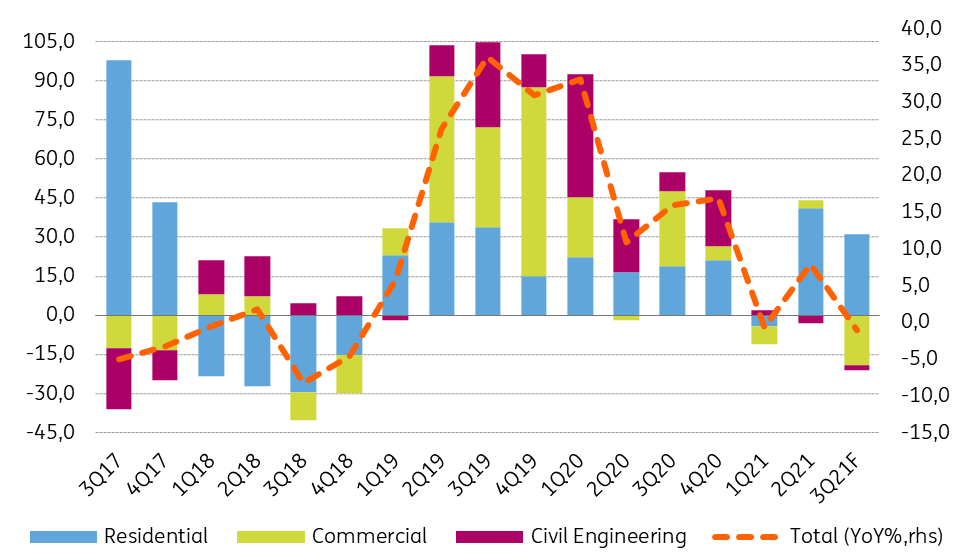

Construction

Following a stellar 2020 when the construction sector expanded by 23%, the 3.1% annual growth after seven months of 2021 might look meagre. However, we underline that this still represents an acceleration from an already very good year. We believe that current dynamics mark a normalisation of the growth pace and are not a prelude to future contraction.

In structure, the residential segment remained the most dynamic. A double-digit annual growth rate has become the norm in this segment over the last few years. However, given its relatively small share in the total index, residential construction couldn’t prevent the construction sector overall from slipping into single digit growth territory this year.

Construction by main groups (YoY%)

Looking forward, we remain cautiously optimistic on the prospects for the sector, though the notoriously high cost increase of the inputs (construction materials in particular) will pressure companies that have locked-in their contracts. Nevertheless, Romania's 2021 budget plans incorporate a 15.8% increase in investment spending, to take the investment-to-GDP ratio to around 5.5% - a new historic high. We believe that the construction sector will be one of the first beneficiaries of the increased investment spending, mainly through public infrastructure works, but also through somewhat more secondary activities such as building repairs and renovations.

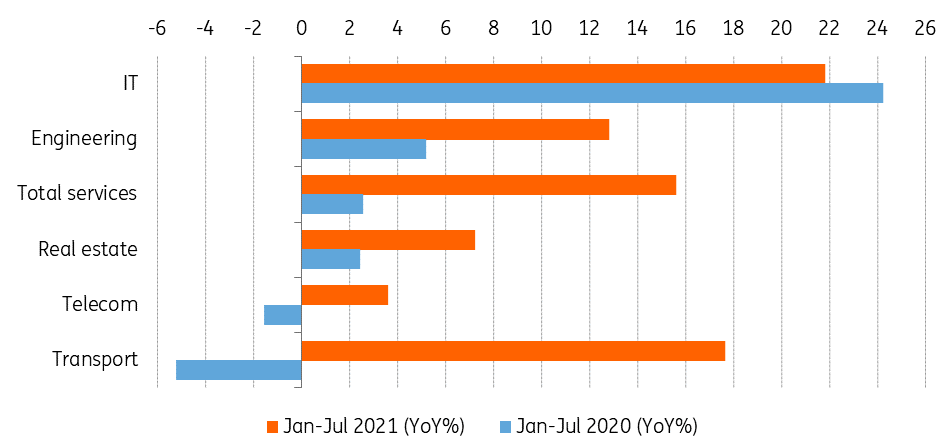

Services

After the first seven months of 2021, most of the service categories are not only above the same period of 2020 -which was to be expected- but even above the 2019 levels. The most dynamic sub-sector remains IT services which have expanded by over 20% compared to 2020 and over 50% compared to the first seven months of 2019, but most of the other services are performing fairly well, too. The fourth wave of coronavirus infections will likely cause a slowdown in the growth pace, particularly in areas of transportation, and hotels, restaurants and cafes. The advance in IT services might also start to ease, but that would be more related to the sector having reached its limits rather than fourth wave effects.

Services and selected sub-sectors (YoY%)

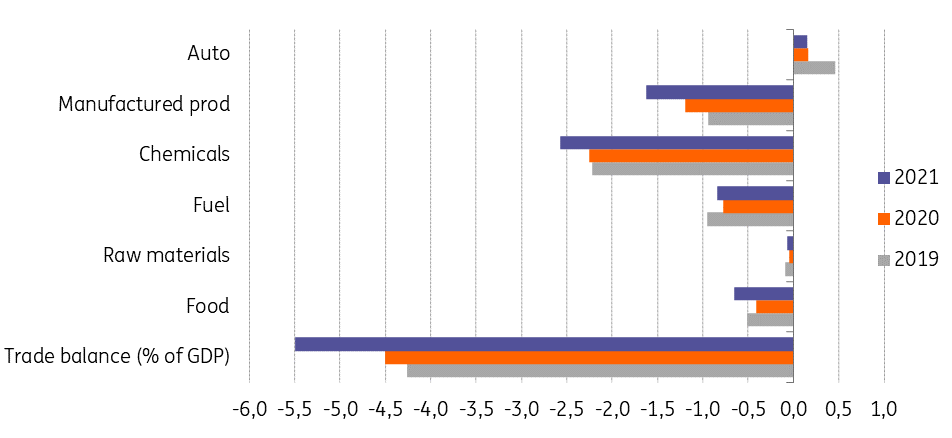

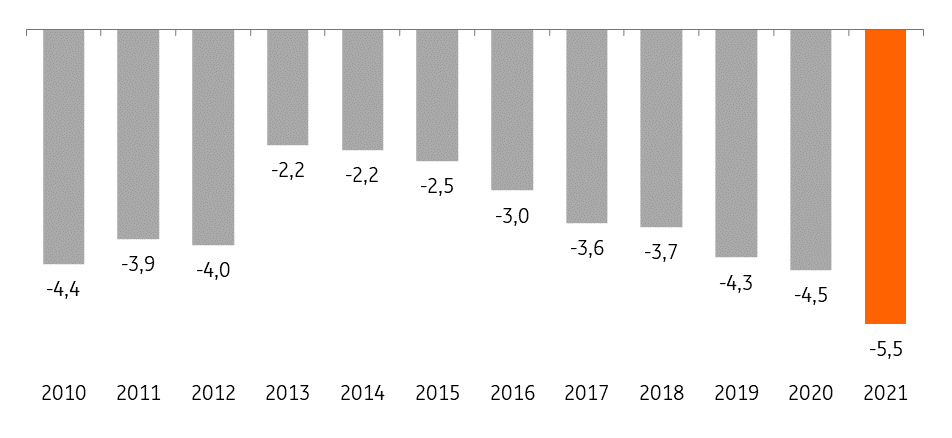

Trade balance

Romania’s trade balance deficit has widened by over 28% in the first seven months of 2021 compared to the same period of 2020, reaching a sizeable EUR12.9bn deficit, or approximately 5.5% of GDP. This is the highest trade deficit after seven months since 2008. Given these numbers, we understandably find little reason to embellish an otherwise grim picture. We do welcome the apparent levelling off in the deterioration of food and fuel sector imbalances, although it is still early to call for a trend reversal here. On the other hand, the surplus in the auto sector shrank to only EUR354m in January-July 2021, the smallest surplus in the last 10 years. This is quite worrying since this segment is the only one where Romania still has a predominantly positive trade balance.

Trade balance (January-July each year, % of GDP)

As things stand right now, Romania seems to be bracing for its highest trade deficit this year since 2008. This will be the main driver behind the current account deficit which might close the year even wider than our 6.0% of GDP estimate.

Trade balance (January-July each year, % of GDP)

Budget and financing

In the recently-approved budget revision, the government decreased the budget deficit target in 2021 from 7.16% of GDP to 7.13% of GDP but has in fact increased the nominal financing needs by just over RON4bn to RON135bn (budget deficit plus redemptions). This is due, on one hand, to a higher nominal GDP estimation (from RON1.14bn to RON1.17bn) and better revenue estimates (+RON17.6bn or c.1.5% of GDP) and, on the other hand, to a whopping upward revision of expenditures (+RON21.4bn or c.1.8% of GDP). Hence, all the extra-income anticipated (and something on top) will be channelled towards increased spending.

Financing-wise, the last couple of months have been rather weak for the Ministry of Finance as increasing bond yields and moderating demand have taken their toll on primary market issuance. Excluding September-to-date issuance, we estimate the financing needs for the remainder of the year at approximately RON10bn per month. Even considering another EUR3bn Eurobond issuance (easier said than done given the local context), the pressure will remain on the local market to buy at least RON6bn of debt each month. Not saying it can't be done, but it certainly won't be easy.

Ratings

After S&P’s decision from April 2021 to improve Romania’s outlook from negative to stable, the chances of maintaining the investment grade rating look solid for the foreseeable future. The political context might complicate the picture a bit after the ruling coalition was broken with the departure of USR-PLUS. While our base case is that the coalition will be restored and no rating actions will be triggered, the risk of a prolonged political crisis is not negligible. This could jeopardise the long-awaited (and hardly even begun) fiscal consolidation process. However, as it is already subject to the EU’s Excessive Deficit Procedure, Romania will be compelled over the coming years to apply fiscal measures designed to bring the budget deficit back within 3.0% of GDP. Although it is not necessarily designed for this purpose, the EDP could be seen as a policy anchor by investors and rating agencies.

Inflation & monetary policy

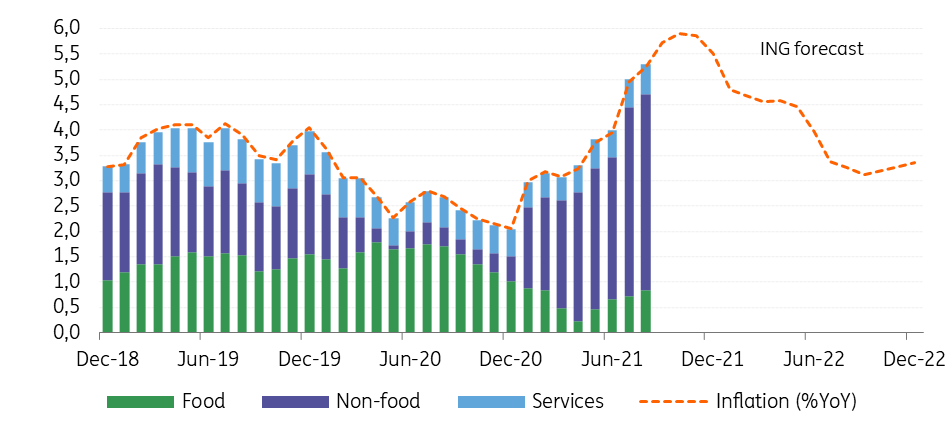

With the inflation rate set to flirt with 6.0% by year-end and at least two regional central banks in tightening mode (Czech Republic and Hungary), the National Bank of Romania (NBR) will have a hard time playing down these developments. We expect the NBR to start increasing its key policy rate (currently at 1.25%) later this year and reach a 2.00% terminal rate by the end of 1Q22. The exact timing of these hikes will be heavily influenced, in our view, by the behaviour of other regional central banks, especially the National Bank of Poland.

For now, the inflation spike is driven mainly by supply side factors outside the NBR’s control (e.g. energy prices), but as the economy continues to advance robustly, demand-driven inflation will start to be more significant. Hence, our current 5.5% year-end inflation estimate looks a touch on the optimistic side and we acknowledge that risks are tilted to the upside.

Inflation (YoY%) and components (ppt)

On the FX front, we do not expect the EUR/RON to break above 4.95 anytime soon, provided no unexpected events occur (e.g. rating downgrade, early elections). The already- elevated inflation and the external imbalances make a meaningful depreciation in the leu quite an undesired development. Should the political waters settle down quickly, we might see the pair being pushed back towards the 4.93 area. Otherwise, 4.95 looks like a very strong resistance level to us.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap