Momentum builds in US manufacturing

Despite the well publicised difficulties in the auto sector, manufacturing production posted a respectable gain after a very strong March. Robust order books and low customer inventories suggest ongoing strength in output while the $2.2tn infrastructure plan offers more opportunities

Manufacturing grows despite supply chain issues

US industrial production rose 0.7% month-on-month in April versus the 0.9% consensus, but as with the retail sales report, look at the revisions – +2.4% growth for March versus the 1.4% initial print. On balance this is a good outcome with manufacturing figures actually coming in better than hoped. Output here rose 0.4% MoM (consensus 0.3%) with March's figure revised up to 3.1% from 2.7%. Utilities output rose 2.6% while mining rose 0.7%.

Looking within the details we can see that auto output was the weak link given the well publicised slowdown relating to a lack of semi-conductor chips that go in anything from brake sensors to satnavs. Defence and space fell 0.1% while construction supply fell 0.9%, but all other components posted gains, including a 2.4% rise in home electronics and 0.6% increases in business supplies and information processing equipment.

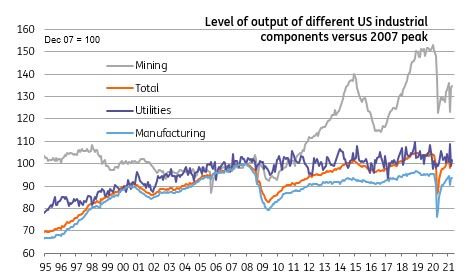

An interesting side point is that while manufacturing output is now only 1.8% below its pre-pandemic peak, having fallen 20.2% between the start and the worst point of the pandemic, it is still 6.3% below the 2008 all-time peak in output. This underlines the long-term decline in the sector and reinforces how difficult a structural turnaround is to generate.

Strong outlook for the rest of 2021

Nonetheless, the ISM report suggests that order books are full with a strong backlog while customer inventory levels are at historically low levels. This is a great position to be in and offers increased pricing power that can be used to cover higher input costs and potentially expand profit margins. President Biden’s $2.2tn infrastructure investment plan should provide additional opportunities for US manufacturing firms.

Rising commodity prices should also provide support over the next few months with Baker Hughes data showing there were an average of 436 oil and gas rigs working in April, up from 408 in March. Already in the first week of May this is up to 448 suggesting strong output gains in this and coming months.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap